Small business owners often grapple with the question: “What’s the average cost of tax preparation by a CPA for small businesses?” At Sager CPA, we understand this concern.

The truth is, CPA tax prep costs can vary widely based on several factors. In this post, we’ll break down these factors, provide cost ranges, and highlight the value-added services that come with professional tax preparation.

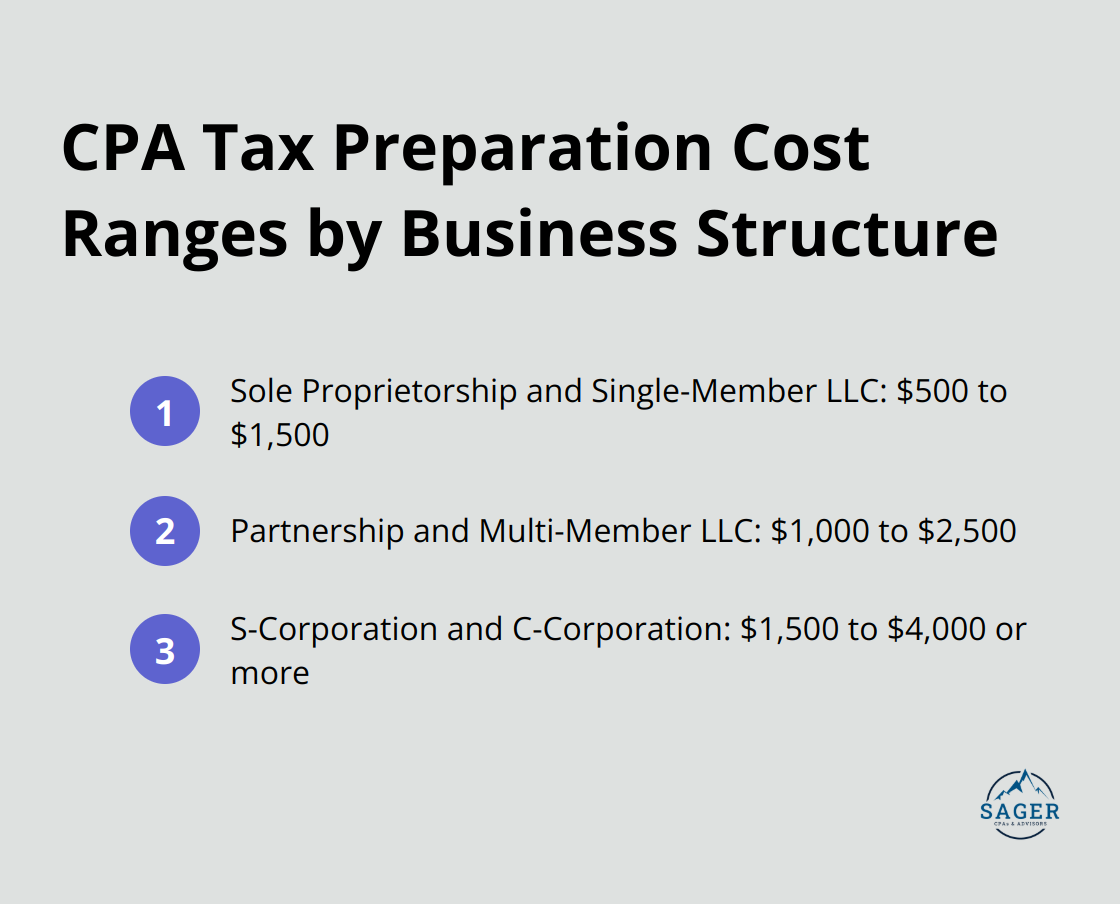

The legal structure of your business significantly affects tax preparation costs. Sole proprietorships and single-member LLCs typically have the simplest tax returns, often resulting in lower CPA fees. Partnerships and multi-member LLCs require more complex filings, which can increase costs. S-corporations and C-corporations usually face the highest preparation fees due to their more intricate tax requirements and additional forms.

The complexity and volume of your financial transactions directly affect CPA costs. Factors affecting pricing include the number of sales and expenses your business handles. A company with high transaction volume and complex financial arrangements will require more time and expertise to prepare taxes accurately, which can influence the cost of tax preparation for small businesses.

The number of employees in your business impacts tax preparation complexity. More employees mean more payroll tax forms, W-2 preparations, and potential benefits considerations. High transaction volume can incrementally increase the time and effort required for tax preparation, thus affecting the overall cost.

Businesses with numerous deductions and credits often require more detailed analysis and documentation, which can increase CPA fees. However, this additional cost can be offset by the potential tax savings these deductions and credits provide. Additionally, compliance with state and local tax requirements adds another layer of complexity. Businesses operating in multiple states or localities may face higher preparation costs due to the need to file multiple returns and navigate various tax laws.

Certain industries (e.g., healthcare, real estate, and construction) have unique tax considerations that can influence preparation costs. These industries often require specialized knowledge and additional forms, which can lead to higher fees. CPAs with industry-specific expertise may charge premium rates for their specialized services.

The factors discussed above provide insight into what influences CPA tax prep costs. However, it’s important to note that these costs can vary widely based on individual circumstances. To get a clearer picture of potential expenses, let’s examine some average cost ranges for CPA tax preparation services across different business types.

Understanding the average costs for CPA tax preparation services helps small business owners budget effectively. Prices vary based on location, complexity, and the CPA’s experience. We provide transparent information to help you make informed decisions.

Tax preparation costs for sole proprietorships and single-member LLCs typically range from $500 to $1,500. These businesses usually have simpler tax returns, which require less time and fewer forms. However, costs increase if there are multiple income streams or complex deductions.

Partnerships and multi-member LLCs often face higher tax preparation fees, ranging from $1,000 to $2,500. The increased cost reflects the additional complexity of these business structures (including the need for Schedule K-1 forms for each partner or member).

S-corporations and C-corporations generally incur the highest tax preparation fees, typically ranging from $1,500 to $4,000 or more. This is due to the more complex reporting requirements and additional forms needed for these entity types. Small business tax return preparation costs can range from $500 to $2,500, with hourly rates averaging $150 to $500 or more. However, rates can vary widely based on location and services provided.

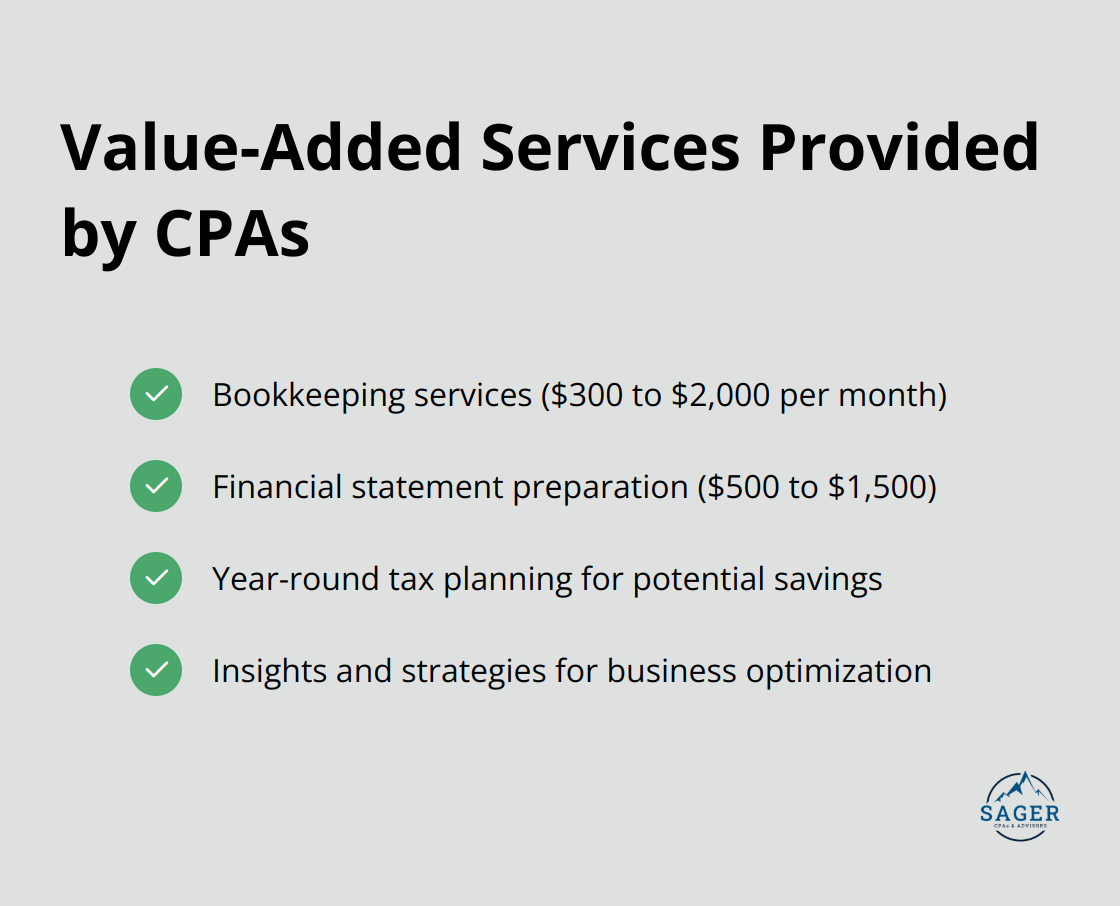

Many small businesses require more than just tax preparation. Bookkeeping services can add $300 to $2,000 per month to your CPA costs, depending on the volume of transactions. Financial statement preparation might cost an additional $500 to $1,500.

While these figures provide a general range, actual costs can vary. Factors such as the organization of your financial records, the complexity of your business operations, and the specific services you require all play a role in determining the final price.

CPAs provide value that extends beyond mere tax preparation. Their services often include year-round tax planning, which can lead to significant savings over time. Small business owners should view CPA services as an investment rather than an expense. The insights and strategies a skilled CPA provides can often result in tax savings that outweigh the cost of their services.

Now that we’ve explored the average costs associated with CPA tax preparation, let’s examine the value-added services that often come with professional tax preparation and how they can benefit your business in the long run.

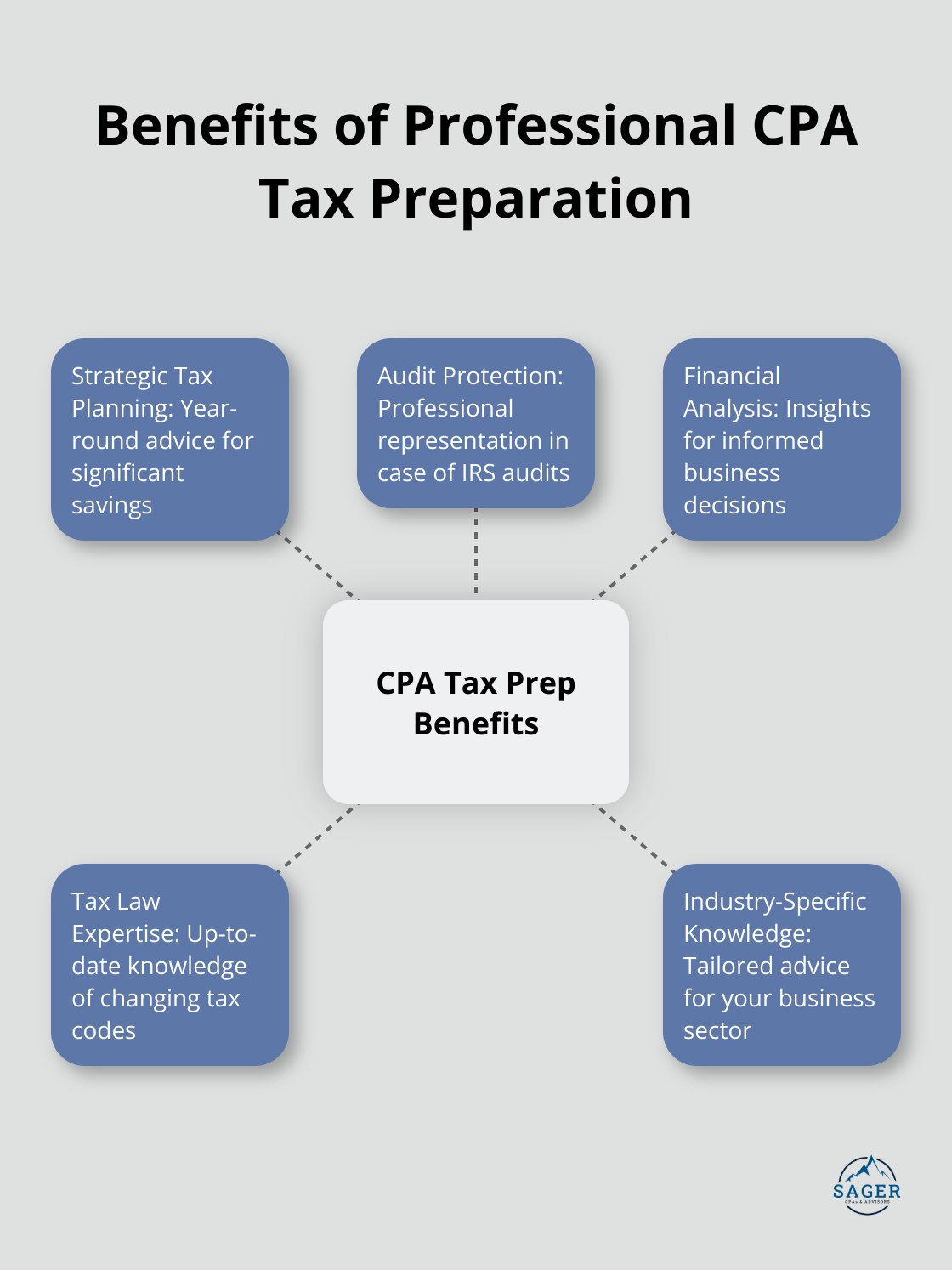

CPAs provide more than just tax return preparation. They offer year-round strategic tax planning. This proactive approach can lead to significant savings. CPAs advise on making the most of home office deductions, deferring income to reduce taxable income, and being proactive about procurement and depreciation.

In the event of an IRS audit, a CPA proves invaluable. Professional tax audit representation can lead to more favorable outcomes and reduced stress during the audit. CPAs handle communications with the IRS and defend your tax positions.

Many CPAs include financial analysis services as part of their tax prep package. These services might encompass cash flow projections, profit margin analysis, or identification of cost reduction areas. Such insights prove crucial for informed business decisions.

Tax laws change frequently, and staying updated requires full-time dedication. CPAs invest in ongoing education to stay current with tax code changes. This ensures that your business benefits from the latest tax-saving opportunities.

Many CPAs specialize in specific industries, offering tailored advice that generic tax software can’t match. This expertise can uncover industry-specific deductions and credits that you might otherwise miss. For example, a CPA with restaurant industry experience will know about specific tax breaks for food inventory donations or energy-efficient equipment installations.

The average cost of tax preparation by a CPA for small businesses varies widely, influenced by factors such as business structure and transaction complexity. CPAs offer more than just tax filing; they provide strategic planning, audit protection, and industry-specific expertise. These services can lead to substantial tax savings and valuable insights for business growth.

We at Sager CPA understand that each business faces unique financial challenges and opportunities. Our team offers tailored financial management and tax planning services to meet your specific needs. We focus on proactive strategies, customized action plans, and enhanced financial clarity to help you make informed decisions throughout the year.

Don’t let tax preparation complexities hinder your business growth. Schedule a consultation with Sager CPA today to discuss your needs and receive personalized pricing. Our comprehensive services extend beyond tax season, making us a financial ally committed to your long-term success.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.