Financial management theory and practice isn’t just for accountants and CFOs. Whether you run a business or manage your own finances, the decisions you make today directly impact your financial health tomorrow.

At Sager CPA, we’ve seen firsthand how the right financial management strategies separate thriving companies from struggling ones. This guide breaks down the core principles, real-world applications, and common pitfalls you need to know.

Financial management rests on three pillars that directly control whether your business survives or thrives: understanding how cash moves through your operations, planning where that money goes, and protecting it from predictable risks. Most businesses fail not because they lack revenue but because they mismanage these three areas. Cash flow is the oxygen of any organization, and without it, growth becomes impossible. Liquidity matters more than profit on paper because you cannot pay employees or vendors with accounting entries. Most owners spend more time on marketing than on understanding their cash position.

The cash conversion cycle-a metric that expresses the length of time, in days, that it takes for a company to convert resources into cash flows-directly determines how much working capital you need. If you sell products with 60-day payment terms but your suppliers demand payment in 30 days, you face a 30-day gap you must fund yourself. This gap grows as you scale, which is why many fast-growing companies paradoxically run out of cash. We’ve worked with companies that looked profitable on their income statement but ran out of cash within months because they didn’t track when customers actually paid or when suppliers demanded payment.

The solution requires separating three cash flow buckets: operating cash flow from your core business, investing cash flow from equipment and assets, and financing cash flow from loans or investments. Track each separately and you’ll spot problems before they become crises.

Budgeting separates businesses that control their destiny from those that react to circumstances. Static budgets-the kind most companies create once yearly and ignore-are useless because business conditions change monthly. Flexible budgets that adjust based on actual revenue and conditions reveal the real picture. If you projected 10,000 units sold but sold only 7,000, your budget needs to reflect that new reality immediately, not at year-end.

Start by tracking your actual spending for three months to establish a baseline, then build a budget that reflects seasonal patterns in your industry. For example, retail businesses see 30-40% of annual revenue in Q4, so budgets must account for this spike. Allocate money to your fixed costs first-rent, payroll, insurance-because these don’t change when sales fluctuate. Then allocate variable costs like materials and commissions. Finally, reserve 10-15% of projected revenue for contingencies and opportunities. This sequence prevents you from overspending on discretionary items when fixed obligations hit.

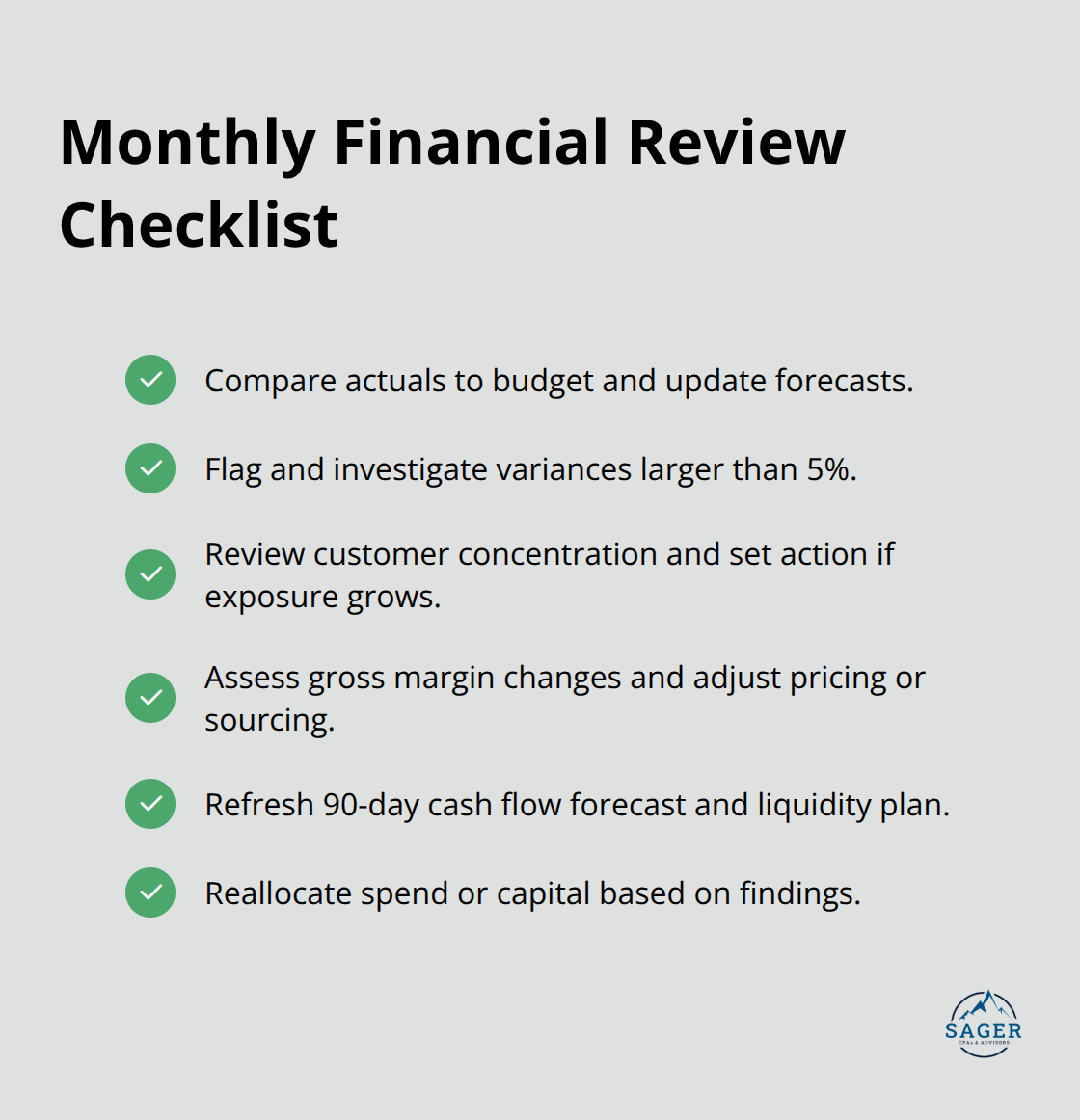

Review your budget monthly against actual results and adjust immediately if revenue or major expenses deviate by more than 5%. Companies that do this catch problems within 30 days instead of 90 days, giving them time to react.

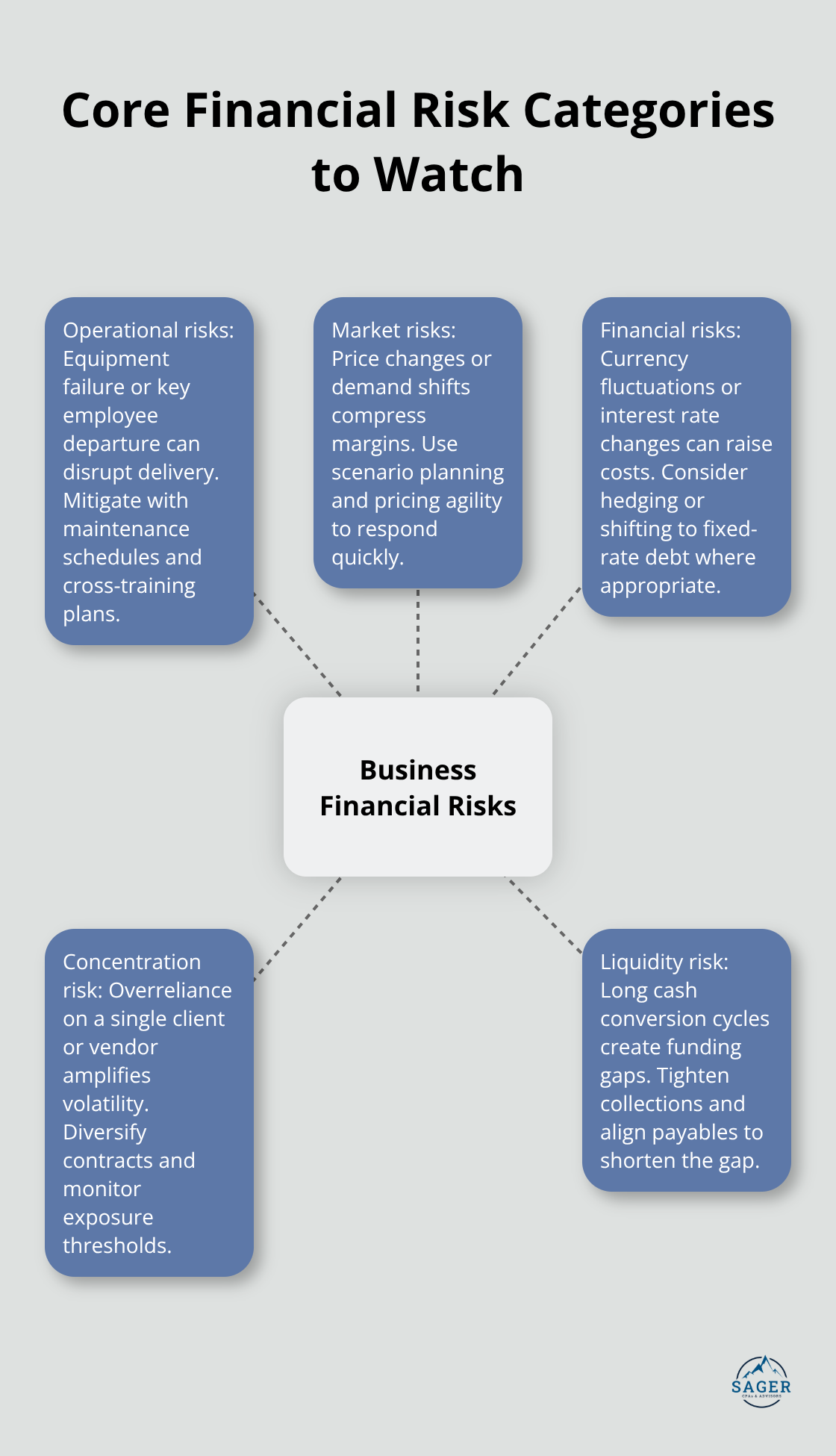

Risk management isn’t about worst-case thinking; it’s about identifying the financial exposures that would genuinely damage your operation. Three categories matter most: operational risks like equipment failure or key employee departure, market risks like price changes or demand shifts, and financial risks like currency fluctuations or interest rate changes.

Map your assets and liabilities across your balance sheet, then ask which ones could hurt most if conditions change. A manufacturer holding three months of inventory faces significant risk if demand drops 20%. A service business with one major client faces concentration risk. A company with variable-rate debt faces interest rate risk.

Document which risks matter most, how you’ll monitor them, and what actions you’ll take if they materialize. This isn’t theoretical planning; it’s the difference between surviving downturns and failing during them.

Asset allocation-deciding what percentage of resources goes to different areas-must reflect both opportunity and risk tolerance. Conservative allocation protects cash but limits growth. Aggressive allocation captures growth but increases vulnerability. The right balance depends on your industry, company stage, and personal circumstances. If you’re bootstrapped with no safety net, conservative allocation makes sense. If you have investors and cash reserves, you can take calculated risks.

These three pillars form the foundation, but they only work when you apply them consistently. The next section shows how businesses actually use these principles to accelerate growth and adapt to market changes.

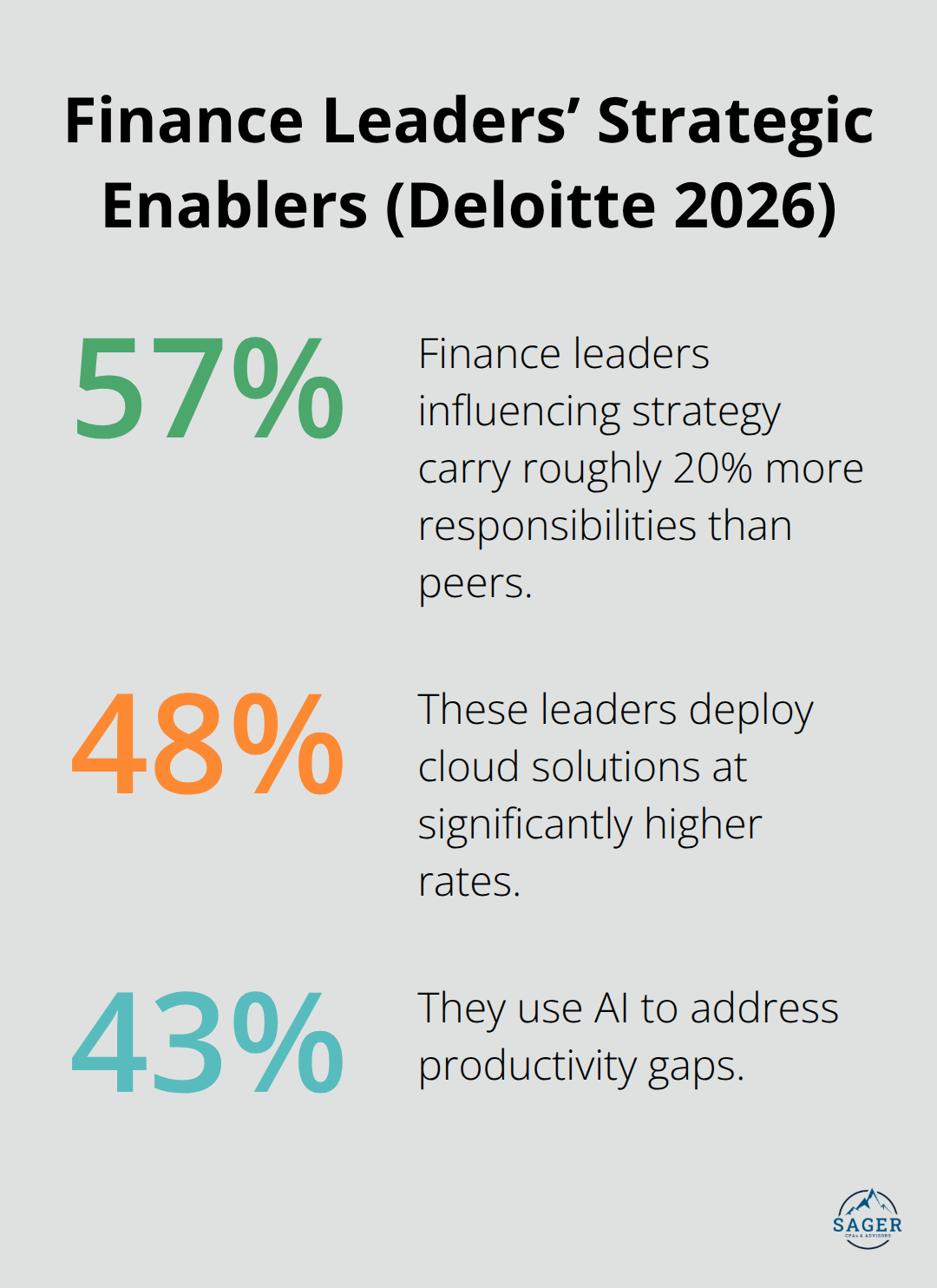

Growth without financial discipline is a myth. Deloitte’s 2026 Finance Trends survey revealed that 57% of finance leaders who influence company strategy carry roughly 20% more responsibilities than their peers, and these leaders deploy cloud solutions at significantly higher rates (48%) and use AI to address productivity gaps (43%). The connection is direct: companies that treat financial management as a strategic function, not just a compliance task, outpace competitors. Walmart demonstrates this principle in practice by running financial scenarios almost daily, integrating pricing, inventory, supplier dynamics, and customer trends into real-time decisions. This isn’t quarterly planning; it’s continuous financial navigation that shapes every operational choice.

When you segment your balance sheet by business line-online versus in-store sales, for example-you immediately see which segments drive profitability and which drain resources. Most owners operate blind to this reality and allocate capital equally across underperforming and high-performing areas. Separate your revenue streams and costs by channel or product line, then allocate growth investment toward the segments generating the highest return on assets. This single shift transforms companies from generalists competing on price into specialists commanding margins.

For personal wealth building, the principle inverts but the discipline remains identical. Your personal balance sheet needs the same rigor: track assets separately from liabilities, segment income sources, and allocate capital based on risk-adjusted returns rather than emotion or habit. Offering discounts for early payment or cash prepayment shortens your cash conversion cycle immediately and reduces the working capital you must finance to fuel growth.

Manufacturing requires different financial management than software because inventory sits on balance sheets for months, tying up capital that service businesses deploy elsewhere. A manufacturer holding three months of inventory faces significant liquidity pressure during demand downturns, while a SaaS company with subscription revenue forecasts cash inflow 12 months ahead. Retail depends on seasonal patterns, with Q4 representing 30-40% of annual revenue in many categories, forcing careful cash reserves in slow seasons. Financial strategy must reflect these structural realities.

Manufacturers should focus on inventory turnover ratios and supplier payment terms negotiation to minimize working capital requirements. Retailers must build cash reserves in Q1-Q3 to cover seasonal cash gaps without emergency borrowing. Service businesses can operate with minimal inventory but face concentration risk if one client represents 30% of revenue-requiring contract diversification strategies. Real estate operations depend entirely on leverage and debt service coverage, making interest rate sensitivity their primary financial risk. The industries that struggle most apply generic financial management templates instead of strategies tailored to their specific cash flow patterns. Ask yourself what creates the largest working capital gap in your industry, then build your financial strategy around solving that specific problem rather than following a textbook approach.

Companies that treat financial management as a competitive weapon rather than a necessary evil gain measurable advantages. Algar Telecom deployed an AI agent called Billy that reviewed 25% of their first invoices in the first nine months of 2025, capturing roughly $1.5 million in incremental profit. This wasn’t cost-cutting; it was profit recovery through disciplined financial processes. Embraer demonstrates how scaling intelligent automation across the enterprise through centers of excellence transforms financial performance across business units. These companies invested in financial infrastructure and process discipline, then leveraged that foundation to identify opportunities competitors missed.

For your business, this means moving beyond monthly budget versus actual reporting toward predictive financial modeling. If you know your cash conversion cycle to the day, understand your customer concentration risk, and forecast cash flow 90 days forward with accuracy, you operate with information advantages your competitors cannot match. That advantage translates directly into faster decision-making during market shifts and capital deployment before opportunities close. The finance leaders who influence strategy do so because they provide decision support that shapes company direction, not because they control the accounting function. Position your financial management the same way: as a strategic tool that informs growth decisions, risk management, and capital allocation rather than as a historical record of what already happened.

The next section addresses the mistakes that prevent most businesses from reaching their financial potential-and how to avoid them.

Most businesses fail at financial management not because they lack ambition but because they operate without buffers. The first mistake is treating emergency reserves as optional. When unexpected expenses hit-equipment breaks, a customer fails to pay, an employee leaves suddenly-companies without reserves scramble to borrow at terrible rates or delay critical spending. Businesses that discover this problem too late have already damaged supplier relationships or missed growth opportunities because cash was unavailable. The rule is simple: reserve three to six months of operating expenses before you invest in growth or expansion.

Calculate your monthly fixed costs-payroll, rent, insurance, utilities-then multiply by the number of months your industry typically experiences cash gaps. For retail, that’s usually five to six months because Q1-Q3 revenue doesn’t cover Q4’s inventory buildup. For service businesses with predictable revenue, three months often suffices. Don’t treat this reserve as a failure; treat it as the price of staying independent when circumstances shift. Without it, you’re one problem away from forced borrowing or selling equity you didn’t intend to sell.

Equally damaging is the belief that you can set a financial strategy once and ignore it. Market conditions change, customer behavior shifts, costs rise unpredictably, and tax laws evolve. Companies that review their financial position only annually miss opportunities to adjust spending, reallocate capital, or capture tax savings that disappear if you wait. The discipline that separates thriving companies from struggling ones is monthly review: compare actual results to budget, identify variances larger than 5%, and adjust immediately.

If customer concentration increases because one client now represents 35% of revenue instead of 20%, that’s a strategic risk requiring action now, not a conversation for next year’s planning cycle. If your gross margin declined 2% because material costs rose, you need to adjust pricing or sourcing this quarter, not hope it reverses next quarter. Companies that conduct these reviews catch problems within 30 days instead of discovering them during tax season or year-end close.

The third mistake costs businesses tens of thousands annually: ignoring tax planning and treating taxes as something you pay after the year ends. Tax strategy isn’t about aggressive avoidance; it’s about understanding which business decisions create tax liability and which create tax benefits, then structuring your decisions accordingly. If you’re operating as a sole proprietor but your business generates $150,000 in profit, you’re paying self-employment tax on all your profits. Operating as an S-corp could reduce that burden because you only pay payroll taxes on your salary portion-the rest comes as distributions and avoids self-employment tax. That structural choice can save thousands annually.

If you’re reinvesting profits into equipment, accelerated depreciation and Section 179 deductions can reduce current-year taxable income significantly. If you’re paying yourself a bonus at year-end, timing that payment affects both your current year and next year’s tax brackets. If you’re making quarterly estimated payments, underpaying now means penalties and interest later, while overpaying means giving the government an interest-free loan. None of these decisions are complicated, but they require planning before the year ends. Most owners discover these opportunities in March when their accountant files the return-six months too late.

The solution is simple: discuss tax strategy with an accountant in September or October, not March. Identify whether your current structure is optimal, whether timing your income or deductions matters, whether you should accelerate or defer expenses into different years, and whether retirement contributions like SEP-IRAs or solo 401(k)s could reduce your taxable income. A few hours of planning conversation in Q4 translates directly into hundreds or thousands in tax savings. Tax strategy varies significantly based on your specific situation rather than generic advice, because what reduces liability for a manufacturing business differs entirely from what works for a professional services firm or e-commerce operation.

Financial management theory and practice converge on a single reality: the decisions you make about cash, budgets, and risk determine whether your business survives or thrives. The principles outlined in this guide aren’t theoretical frameworks gathering dust in textbooks-they’re operational disciplines that separate companies capturing growth from those struggling to stay afloat. Your financial strategy must reflect your specific situation, not generic templates, because a manufacturing business faces entirely different working capital pressures than a software company, and a retail operation needs cash reserves that a service business doesn’t.

Start by implementing one principle immediately. If you lack emergency reserves, build them before anything else. If you haven’t reviewed your financial position in months, schedule that review this week. If you operate without a tax strategy, contact an accountant in Q4 to plan for next year, because small actions compound into competitive advantages over time.

The complexity of modern financial management-integrating budgets with forecasts, monitoring cash conversion cycles, managing tax liability across multiple structures, and positioning your company for growth-makes professional guidance valuable. We at Sager CPA work with businesses and individuals to translate financial management principles into customized action plans that reduce tax liability, clarify financial position, and support informed decision-making. Schedule a consultation with Sager CPA to create a personalized financial strategy tailored to your specific circumstances and goals.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.