Tax saving strategies can significantly impact your financial well-being. At Sager CPA, we’ve seen how proper planning can lead to substantial savings for our clients.

This blog post will guide you through effective methods to reduce your tax burden and keep more money in your pocket. We’ll cover everything from understanding your tax situation to implementing advanced tax planning techniques.

List all your income sources. This includes wages, self-employment income, rental income, investment returns, and any other money you’ve earned. Each type of income faces different tax treatment, so knowing the breakdown is essential. Long-term capital gains, for example, typically incur lower tax rates than ordinary income.

Examine your current deductions and credits. Try to take full advantage of all available options. Common deductions include mortgage interest, state and local taxes, and charitable contributions. Credits (which directly reduce your tax bill) might include the Child Tax Credit or education-related credits. The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return. The IRS reports that in 2022, over 75% of taxpayers claimed the standard deduction rather than itemizing. However, itemizing could lead to more significant savings for some individuals.

Search for areas where you might miss out on tax savings. Self-employed individuals should check if they deduct all eligible business expenses. The Small Business Administration notes that many entrepreneurs overlook deductions for home office use, vehicle expenses, and professional development costs.

Know your tax bracket and your proximity to the next one. This knowledge can inform decisions about income timing or deductions. For 2025, the top individual income tax rate will increase from 37% to 39.6%, which could affect high-income earners.

Don’t overlook state and local taxes. Some states have no income tax, while others have rates exceeding 10%. If you’ve worked remotely in different states, you might face complex tax situations. The increased SALT cap is subject to a phasedown once modified adjusted gross income (MAGI) exceeds $500,000 for 2025 and $505,000 for 2026.

A thorough understanding of your tax situation equips you to make informed decisions that can lead to substantial savings. Tax laws change frequently, so staying informed (or working with a professional) can help you adapt your strategies effectively. As we move forward, let’s explore how to maximize deductions and credits to further reduce your tax burden.

Maximizing deductions and credits can significantly reduce your tax burden. Let’s explore effective strategies to boost your tax savings.

Business owners and self-employed individuals have numerous deduction opportunities. Track all your expenses meticulously, including office supplies, travel costs, and a portion of your home expenses for a dedicated home office. The IRS allows deductions for various business-related costs, potentially saving you thousands of dollars annually.

Don’t overlook less obvious deductions. Professional development costs (such as courses or conferences) are often deductible. If you use your personal vehicle for business, keep a mileage log. The IRS standard mileage rate for 2025 is 58.5 cents per mile for business use, which can add up quickly.

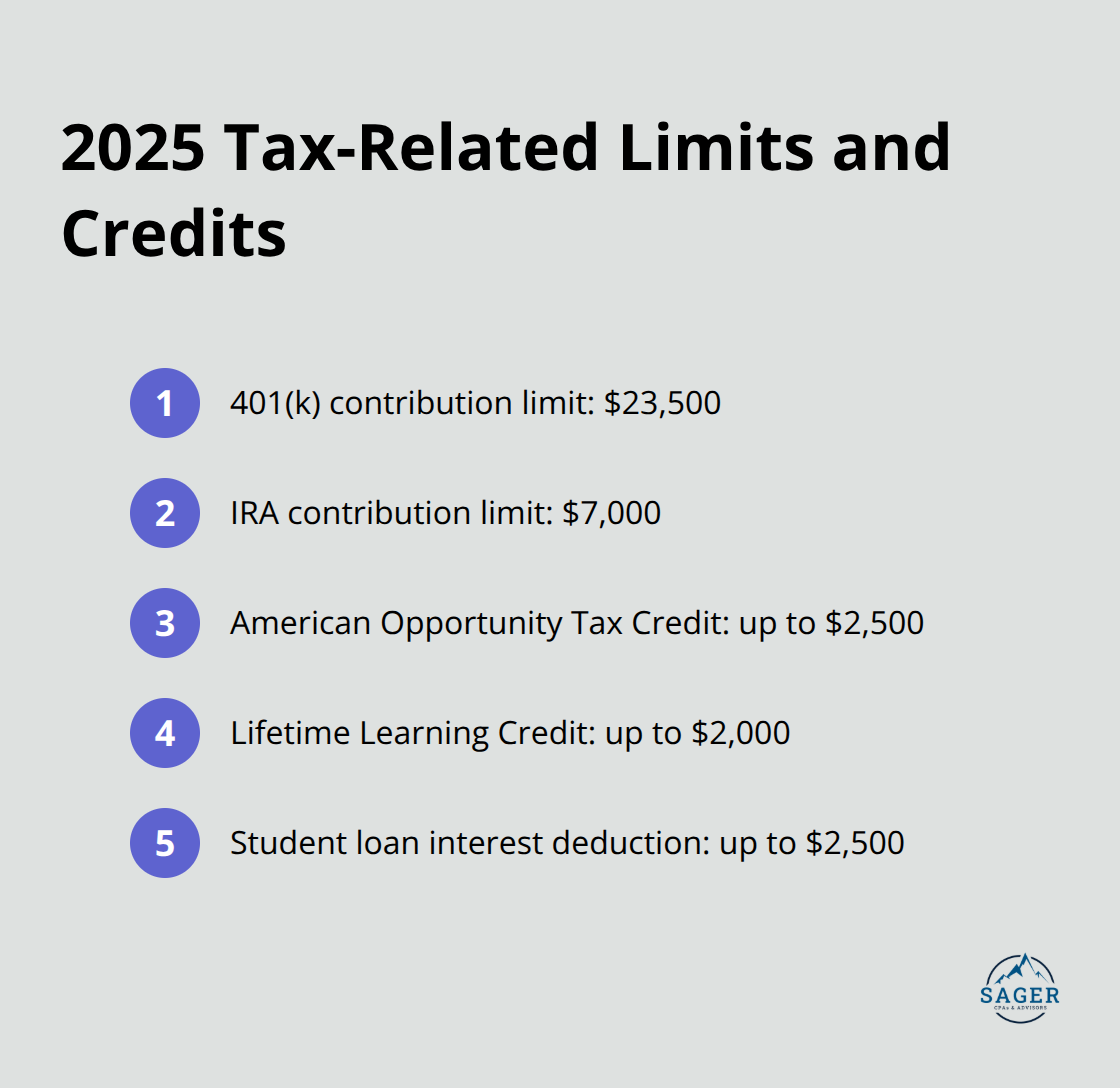

Contributions to retirement accounts offer dual benefits: they secure your financial future and provide immediate tax advantages. For 2025, you can contribute up to $23,500 to a 401(k) plan (with an additional $7,500 catch-up contribution if you’re 50 or older). These contributions reduce your taxable income dollar-for-dollar.

Try to max out your IRA contributions as well. For 2025, the limit is $7,000 (with an extra $1,000 catch-up contribution for those 50 and above). Depending on your income and whether you’re covered by a workplace retirement plan, these contributions might be tax-deductible.

If you or your dependents attend school, don’t miss out on education-related tax benefits. The American Opportunity Tax Credit offers up to $2,500 per eligible student. The Lifetime Learning Credit provides up to $2,000 per tax return for qualified education expenses, with no limit on the number of years you can claim it.

Student loan interest is also deductible, up to $2,500 annually, depending on your income. This deduction is particularly valuable because it’s an “above-the-line” deduction, meaning you can claim it even if you don’t itemize.

Charitable giving isn’t just good for the community; it can significantly reduce your taxable income. If you itemize deductions, you can deduct donations to qualified charities. Consider bunching your donations into a single tax year to exceed the standard deduction threshold.

For those aged 70½ or older, Qualified Charitable Distributions (QCDs) from IRAs offer a unique opportunity. You can donate up to $105,000 directly from your IRA to a qualified charity. Generally, IRA distributions are taxable, but QCDs remain tax-free if sent directly to a qualified charity by the trustee.

These strategies can help you make the most of available deductions and credits. However, tax laws are complex and ever-changing. Working with a professional tax advisor ensures you don’t miss any opportunities to reduce your tax liability. Now, let’s explore some advanced tax planning techniques that can further optimize your tax situation.

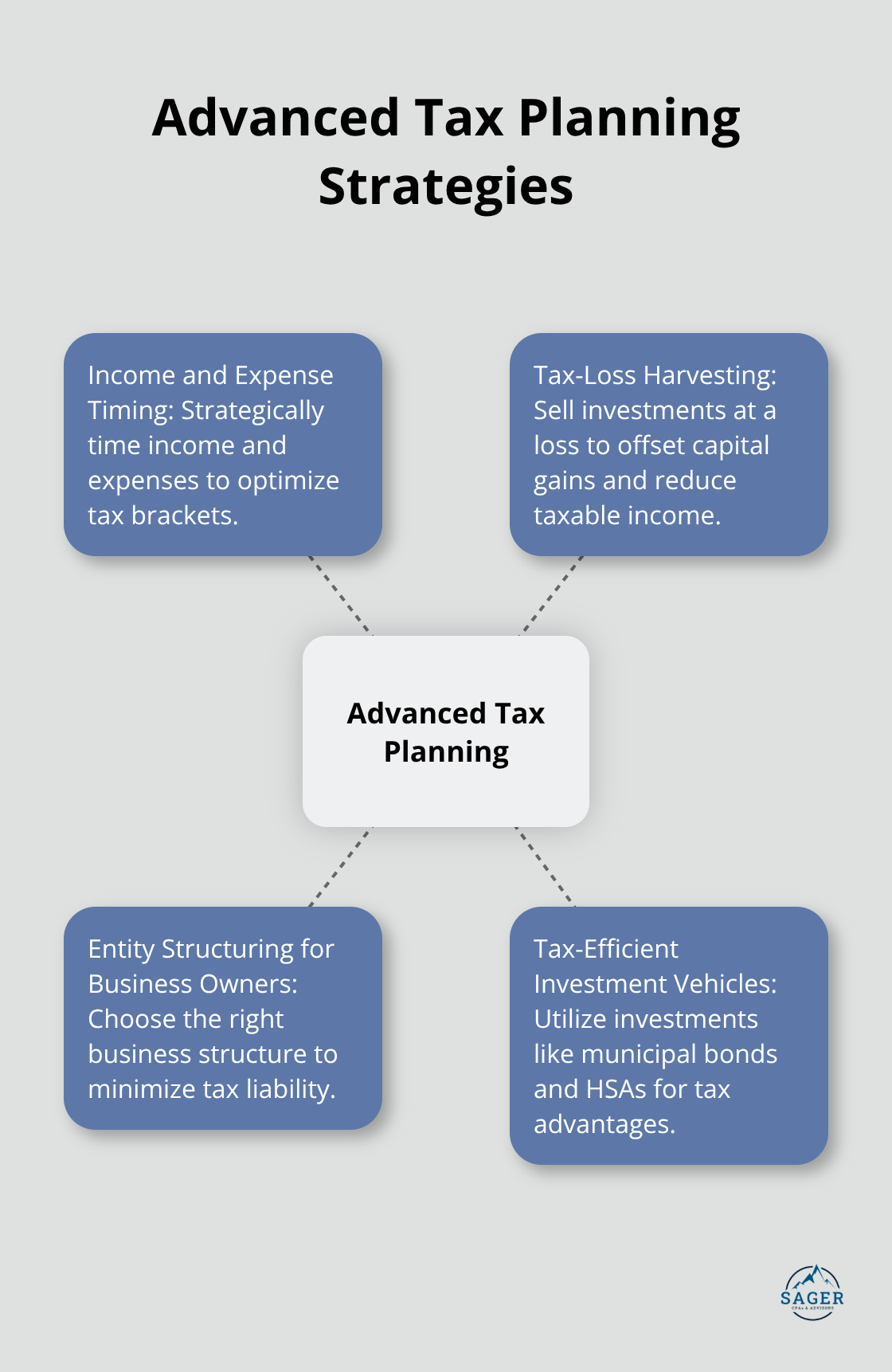

You can reduce your tax liability by strategically timing your income and expenses. If you’re self-employed or control when you bill clients, consider deferring income to the following year if you expect to be in a lower tax bracket. Alternatively, if you anticipate a higher bracket next year, accelerate income into the current year.

For expenses, apply the reverse strategy. Cash-basis taxpayers can reduce their current year’s taxable income by paying deductible expenses before year-end. This might include prepaying property taxes, making an extra mortgage payment, or purchasing office supplies in bulk.

Tax-loss harvesting is when you sell investments at a loss and use those losses to offset gains in other investments. The IRS allows you to deduct up to $3,000 of net capital losses against your ordinary income each year (with any excess carried forward to future years).

For instance, if you have $10,000 in capital gains and sell underperforming stocks for a $13,000 loss, you can offset your gains entirely and deduct an additional $3,000 against your ordinary income. The remaining $4,000 loss can be carried forward to future tax years.

Your business structure significantly impacts your tax liability. Different entities (sole proprietorships, partnerships, S corporations, and C corporations) face different tax treatments. Each has advantages and disadvantages depending on your specific situation.

An S corporation, for example, can help self-employed individuals save on self-employment taxes. You can reduce your overall tax burden by paying yourself a reasonable salary and taking the rest as distributions. However, this strategy requires careful planning and documentation to comply with IRS regulations.

Consider using tax-efficient investment vehicles to minimize your tax burden. Municipal bonds, for instance, provide tax-free interest income at the federal level (and often at the state level for in-state bonds). Exchange-traded funds (ETFs) typically generate fewer taxable events than actively managed mutual funds.

Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, you can contribute up to $4,300 if you are covered by a high-deductible health plan just for yourself, or $8,550 if you have coverage for your family.

These strategies can lead to substantial tax savings, but they require careful planning and execution. We at Sager CPA specialize in developing tailored tax strategies that align with your financial goals. Our expertise can help you navigate these complex techniques and ensure you maximize every tax-saving opportunity.

Effective tax saving strategies will significantly impact your financial well-being. You can reduce your tax burden through income source analysis, deduction maximization, and advanced planning techniques. Regular tax planning reviews will help you stay ahead of changing laws and optimize your financial position.

Tax regulations evolve, and your personal circumstances may shift. You must reassess your strategies periodically to ensure they align with your current situation. What worked last year might not be the best approach this year, so you should maintain a proactive stance.

A professional tax advisor will offer substantial benefits in navigating complex tax laws. Sager CPA specializes in developing tailored tax strategies that align with unique financial goals. Our expertise can help you identify overlooked opportunities and make informed decisions about your finances (while ensuring compliance with all relevant regulations).

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.