Tax preparation qualifications are essential for anyone looking to enter this field. At Sager CPA, we understand the importance of meeting these requirements to provide top-notch service to our clients.

This guide will walk you through the educational, certification, and practical experience needed to become a qualified tax preparer. We’ll also explore the career outlook and the ongoing commitment to staying updated with ever-changing tax laws.

Tax preparation demands a solid educational foundation. The baseline for entering this field is typically a high school diploma or equivalent. However, most employers prefer candidates with at least some college-level education in accounting or a related field. This preference stems from the complex nature of tax laws and financial regulations.

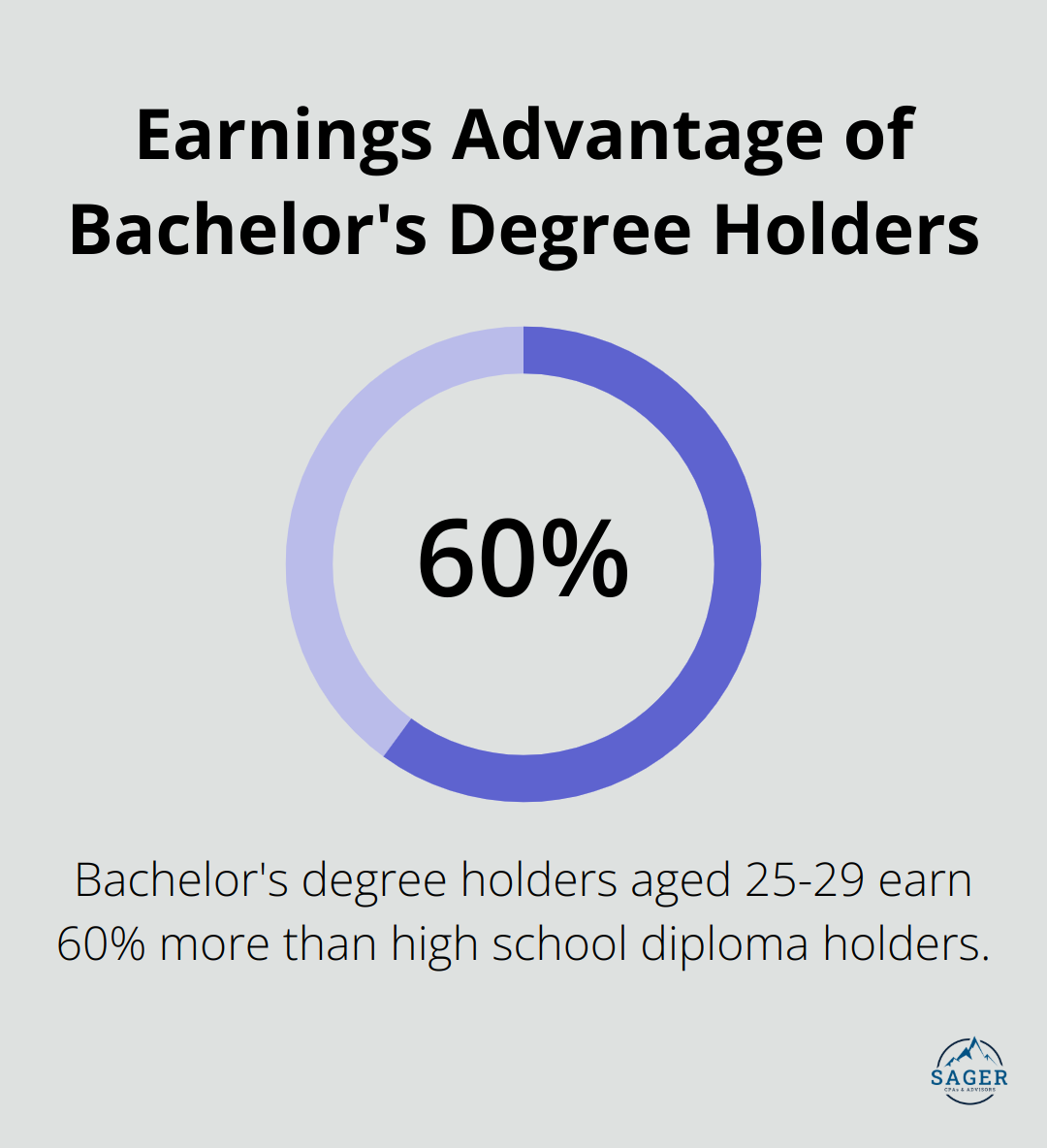

While specific statistics about tax preparers’ education levels may vary, it’s clear that higher education can significantly impact earnings potential in this field. According to the College Board, bachelor’s degree holders aged 25-29 earn 60% more than those with only a high school diploma.

While not always mandatory, a bachelor’s degree can significantly boost your prospects in tax preparation. The most relevant majors include:

Professionals with these educational backgrounds often have a more holistic understanding of financial matters, which translates to better service for clients.

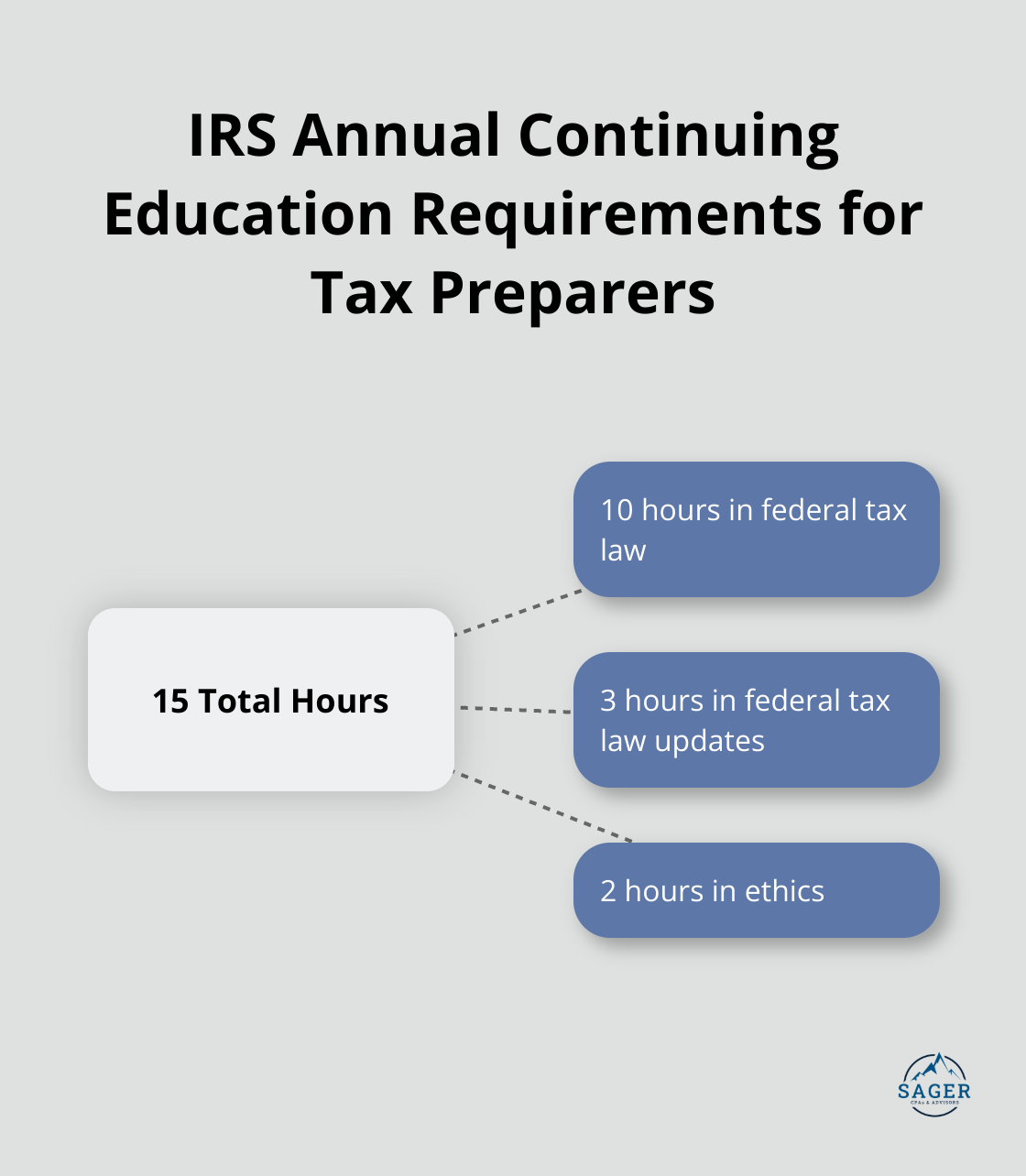

The tax landscape changes constantly, making continuing education not just beneficial, but essential. The IRS requires all tax preparers to complete a minimum of 15 hours of continuing education annually. This includes:

Many professionals pursue advanced certifications like the Enrolled Agent (EA) or Certified Public Accountant (CPA) designations, which have their own rigorous continuing education requirements.

For instance, Enrolled Agents must pass a comprehensive three-part Special Enrollment Examination and undergo a suitability check. This ongoing learning ensures that tax professionals stay at the forefront of tax law changes and can provide the most up-to-date advice to their clients.

Education in tax preparation isn’t just about meeting requirements-it’s about building a foundation for a successful career. Whether you start out or look to advance in the field, investing in your education is a smart move that can pay dividends throughout your career.

Now that we’ve covered the educational aspects of tax preparation, let’s move on to the next critical component: certification and licensing requirements. These credentials can set you apart in the field and open up new opportunities for career advancement.

Tax preparation certifications establish credibility and expertise in the field. These credentials open doors and enhance a tax professional’s career.

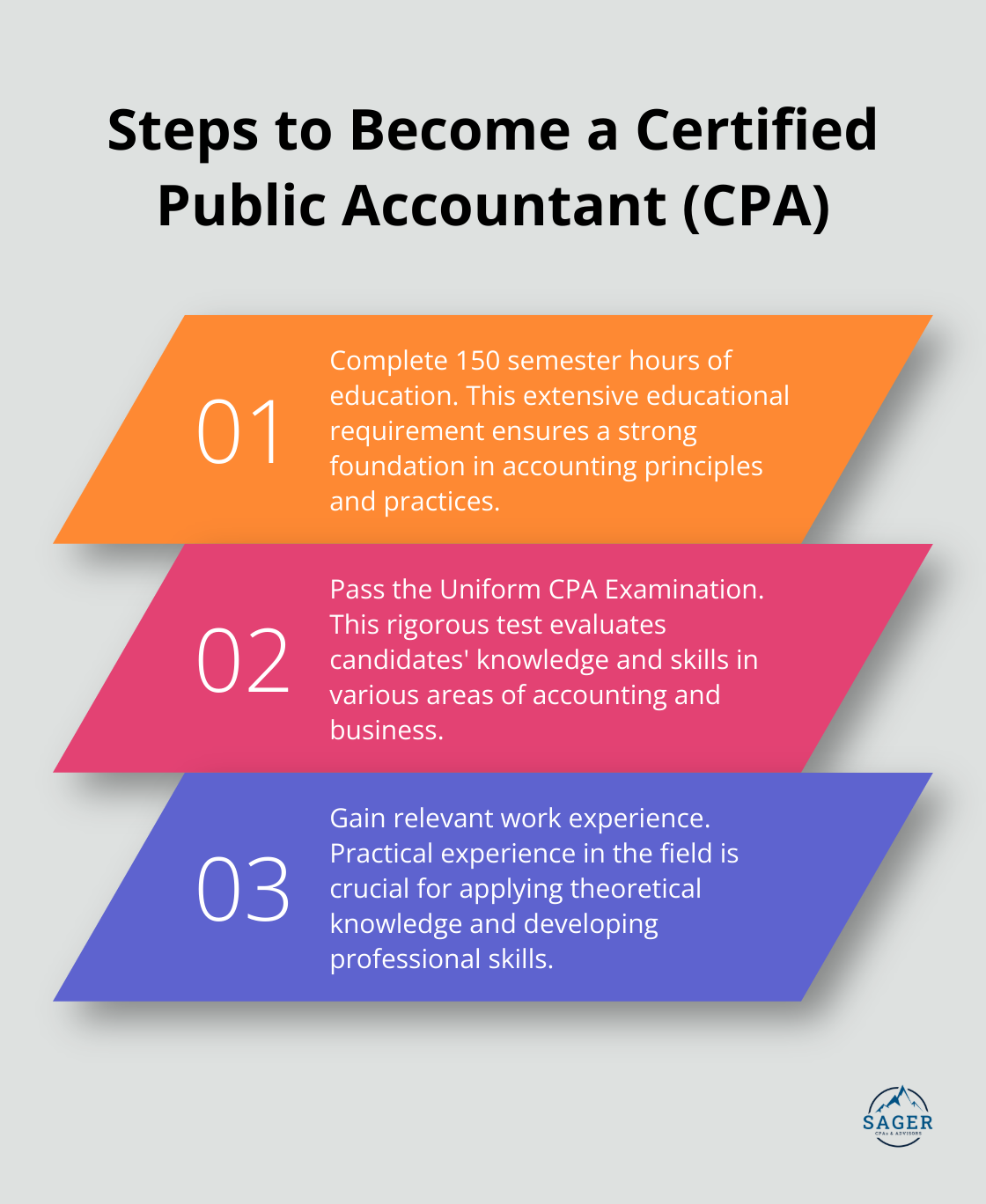

The CPA designation holds wide recognition and respect in the financial world. To become a CPA, you must:

CPA certification requirements include specific education, experience, and exams. The process may vary depending on the state.

The EA credential, issued by the IRS, allows representation of taxpayers before the IRS for audits, collections, and appeals. To become an EA:

The SEE consists of three parts and requires extensive knowledge of tax laws.

State-specific licensing requirements demand attention. For example:

Check with your state’s board of accountancy or department of revenue for specific requirements, which may include:

Effective exam preparation strategies include:

These certifications represent investments in your career. The process may challenge you, but the rewards in career opportunities and earning potential prove significant.

As we move forward, let’s explore the practical experience and skills that complement these certifications and further enhance your qualifications as a tax preparer.

Internships provide invaluable exposure to real-world tax scenarios. Many accounting firms offer internship programs that combine training and practical work. These programs typically run during tax season (January to April), allowing interns to experience the busiest time in the tax world.

Research shows that organizations intentional in recruiting interns are rewarded with higher intern-to full-time-hire conversion rates. This highlights the importance of internships as a stepping stone to a career in tax preparation.

Tax preparers must master several technical skills to succeed. Proficiency in tax software is non-negotiable. Popular programs include UltraTax CS, Lacerte, and ProSeries. Many firms provide training on their preferred software, but self-study options exist online.

Excel proficiency is another must-have skill. Advanced functions like VLOOKUP and pivot tables can streamline tax preparation processes significantly. Online platforms offer comprehensive Excel training tailored for finance professionals.

Data analysis skills continue to grow in importance. The ability to interpret financial statements, identify trends, and spot anomalies can set you apart in the field. A course in data analytics for finance can enhance your skill set.

While technical skills matter, soft skills often determine long-term success in tax preparation. Clear communication stands out as paramount. You must explain complex tax concepts in simple terms that clients understand.

Active listening plays an equally important role. Truly hearing and understanding your clients’ needs and concerns allows you to provide more tailored and effective tax solutions. This skill also helps build trust and long-term relationships with clients.

Time management becomes critical during tax season. The ability to juggle multiple clients and deadlines while maintaining accuracy develops with experience. Tools like Trello or Asana (project management software) can help manage tasks and deadlines effectively.

Continuous learning characterizes successful tax preparers. Tax laws change frequently, and staying updated is important. You should allocate time each week to read industry publications, attend webinars, or participate in professional development courses.

Networking plays a vital role in the tax preparation field. Attend industry events, join professional associations, and connect with colleagues on LinkedIn. A strong network can provide job opportunities, mentorship, and valuable insights into industry trends.

Consider joining organizations like the National Association of Tax Professionals (NATP) or the National Society of Tax Professionals (NSTP). These groups offer resources, continuing education, and networking opportunities that can accelerate your career growth.

A career in tax preparation requires education, certification, and practical experience. These tax preparation qualifications form the foundation of expertise in the field. Certifications such as CPA and EA validate knowledge and create new career opportunities.

Practical experience bridges theoretical knowledge and real-world application. Technical proficiency in tax software and data analysis tools, along with soft skills like communication, set successful tax preparers apart. The dynamic nature of tax laws emphasizes the need for continuous learning.

We at Sager CPA understand the importance of tax preparation qualifications in delivering top-tier financial services. Our team combines extensive knowledge with practical experience to provide comprehensive tax planning and preparation services. Whether you start your journey in tax preparation or look to enhance your skills, investing in your qualifications will lead to future success in this rewarding field.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.