Year-end business tax planning can be a daunting task for many entrepreneurs. At Sager CPA, we understand the challenges and complexities involved in this process.

Proper planning not only helps you stay compliant but can also lead to significant tax savings. This guide will walk you through essential steps to effectively prepare for your year-end business taxes.

The foundation of effective year-end tax planning starts with gathering and organizing financial documents. At Sager CPA, we recommend collecting your income statements, balance sheets, and cash flow statements. These documents offer a comprehensive overview of your business’s financial health. Income statements reveal your revenue and expenses, balance sheets outline your assets and liabilities, and cash flow statements track the movement of money in and out of your business. Together, they create a clear picture of your financial position.

Compile all receipts for business expenses and potential deductions. This includes everything from office supplies and equipment purchases to travel costs and client entertainment expenses. Don’t overlook smaller expenses – they can add up quickly. Many businesses find success using accounting software or apps to digitize and categorize receipts throughout the year (making this process much smoother come tax time).

Review your payroll records and employee benefit information thoroughly. This includes W-2 forms, 1099 forms for contractors, and documentation related to employee benefits (such as health insurance and retirement plans). Accurate payroll records are vital not only for tax purposes but also for compliance with labor laws.

The more organized and complete your financial documents are, the easier it becomes to identify tax-saving opportunities and ensure compliance. Try to create a system that works for your business, whether it’s digital folders, physical filing cabinets, or a combination of both. Consistent organization throughout the year can save you time and stress during tax season.

Consider using cloud-based accounting software to streamline your document management. These tools can automatically categorize expenses, generate financial reports, and even integrate with your bank accounts for real-time updates. This technology not only makes year-end tax preparation easier but also provides valuable insights into your business finances throughout the year.

With your financial documents in order, you’re now ready to explore ways to maximize your tax deductions and credits. Let’s examine some strategies to reduce your tax liability and improve your bottom line.

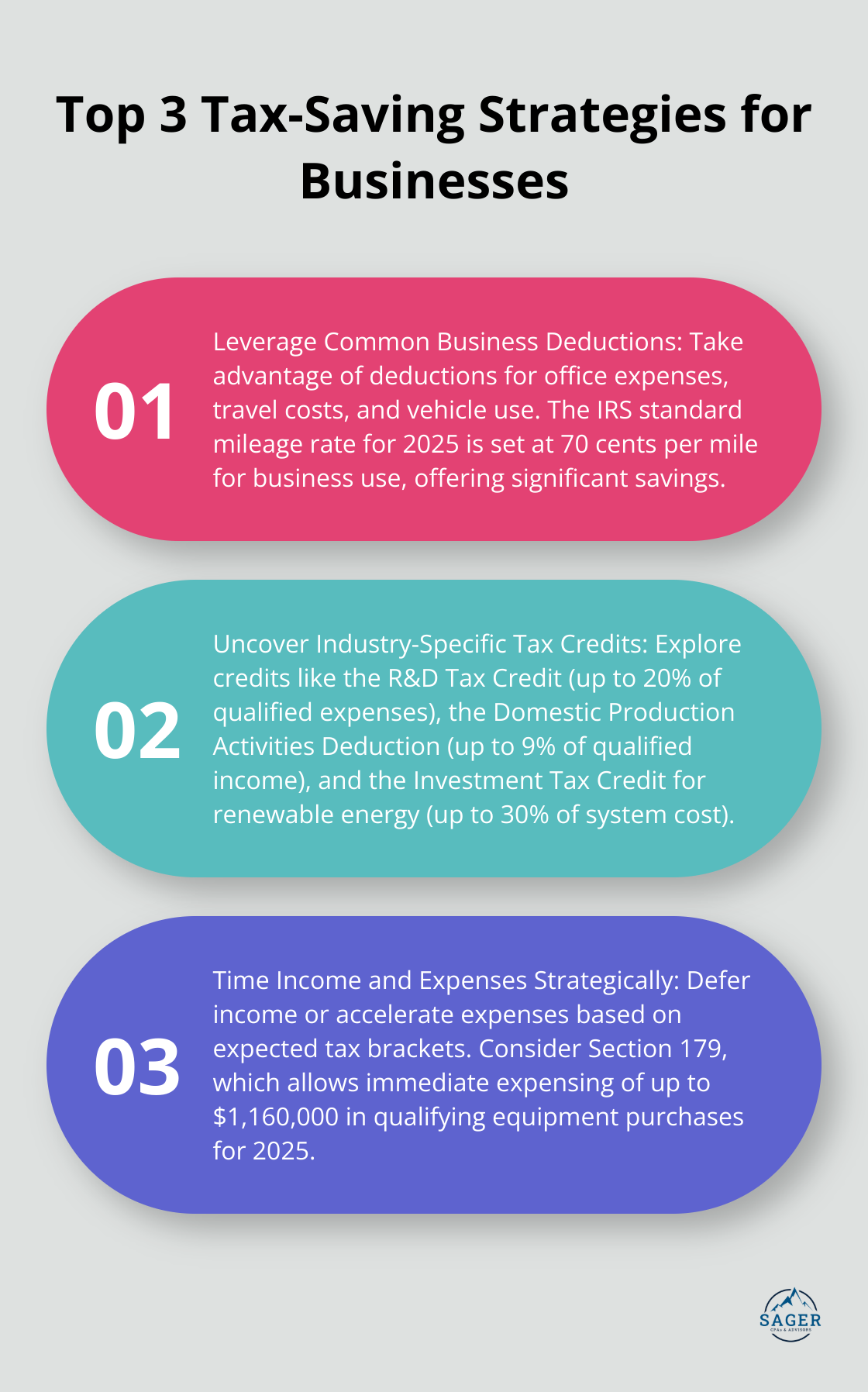

Office expenses and travel costs represent only a fraction of potential business deductions. Vehicle expenses offer significant savings, with the IRS standard mileage rate set at 70 cents per mile for business use in 2025. Home office deductions can lead to substantial savings for those who use a portion of their home exclusively for business (deduct a percentage of mortgage interest, property taxes, utilities, and insurance). Professional development costs, such as courses and certifications, are fully deductible and enhance business capabilities.

Tax credits directly reduce your tax bill dollar-for-dollar, making them more valuable than deductions. The Research and Development (R&D) Tax Credit offers up to 20% of qualified expenses for businesses developing new products or processes. Manufacturing businesses can benefit from the Domestic Production Activities Deduction, providing up to 9% of qualified production activities income. Renewable energy investments qualify for the Investment Tax Credit, covering up to 30% of the cost of clean energy systems. Small businesses should explore the Small Business Health Care Tax Credit, which can cover up to 50% of employee premium costs for eligible employers.

Timing plays a critical role in tax planning. If you expect a lower tax bracket next year, defer income by delaying billing or pushing year-end bonuses to January. Conversely, accelerate income into the current year if you anticipate higher income next year. Prepay deductible expenses like rent, insurance premiums, or subscriptions before year-end to increase current year deductions (but avoid creating a cash flow crunch). For businesses with significant equipment needs, Section 179 of the tax code allows for immediate expensing of up to $1,160,000 in qualifying equipment purchases for 2025, dramatically reducing taxable income in the year of purchase.

Contributions to qualified retirement plans offer dual benefits: they reduce your current tax liability and build tax-deferred income for the future. In 2025, you can contribute up to $23,000 to a 401(k) plan ($30,500 if you’re 50 or older). For SEP IRAs, the limit is 25% of compensation or $69,000, whichever is less. These contributions not only slash your tax bill but also secure your financial future.

Tax laws change frequently, and their complexity can overwhelm even the most diligent business owner. A qualified tax professional can help you navigate these waters, ensuring you take advantage of every available opportunity to minimize your tax liability. They can also help you avoid costly mistakes and potential audits. While software tools offer basic guidance, a seasoned tax expert provides personalized strategies tailored to your unique business situation.

As you implement these tax-saving strategies, you’ll want to ensure you’re working with a knowledgeable professional who can maximize your savings while keeping you compliant. Let’s explore the benefits of partnering with a tax expert for your year-end planning.

A Certified Public Accountant (CPA) can help reduce your business’s tax burden while ensuring compliance with all applicable tax laws. CPAs don’t simply fill out forms; they actively seek opportunities to reduce your tax burden. Their expertise often leads to significant savings that outweigh the cost of professional services.

Tax laws change frequently. In 2025, we’ll see major shifts in retirement contribution limits and potential changes to business deductions. For example, individuals who are age 65 and older may claim an additional deduction of $6,000 from 2025 through 2028. A CPA stays informed about these changes, ensuring your business capitalizes on new opportunities and avoids penalties from outdated practices. This proactive approach protects you from costly mistakes and potential audits.

Cookie-cutter solutions often miss valuable opportunities. A CPA will take time to understand your specific financial situation, industry challenges, and growth goals. They then craft a tax strategy that aligns with your broader business objectives. This personalized approach maximizes your tax benefits while supporting your long-term business vision.

Effective tax planning isn’t a year-end scramble; it’s an ongoing process. A CPA provides continuous financial guidance that drives your business forward. They offer insights and adjustments throughout the year, ensuring you make informed decisions that positively impact your tax situation.

Navigating complex tax laws and forms consumes valuable time and energy. A CPA takes this burden off your shoulders, allowing you to focus on running and growing your business. Their expertise also provides peace of mind, knowing that your taxes are handled correctly and efficiently.

Year-end business tax planning provides a powerful opportunity to improve your company’s financial health. A proactive approach allows you to maximize deductions, capitalize on available credits, and reduce your tax liability. Early planning gives you time to make informed decisions and implement necessary changes before the year-end rush.

Professional advice proves invaluable for navigating complex tax laws and identifying hidden savings opportunities. We at Sager CPA specialize in tailored financial management and tax planning services. Our experienced team can help you develop a comprehensive strategy to minimize your tax burden while ensuring compliance.

Take control of your taxes and optimize your financial position for growth in the coming year. With careful planning (and expert guidance), you can transform tax season from a stressful obligation into a strategic opportunity for your business. Don’t leave your business’s financial future to chance.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.