Real estate investments can be a powerful wealth-building tool, but they come with complex tax implications. At Sager CPA, we understand the importance of effective tax planning for real estate investors.

This guide will walk you through essential strategies to optimize your tax position and maximize your returns. From understanding basic concepts to exploring advanced techniques, we’ll provide you with practical insights to navigate the intricate world of real estate taxation.

Real estate investments offer unique tax considerations that can significantly impact your overall returns. Understanding these implications will help you make informed decisions in the real estate market.

The IRS requires you to report all income received from tenants on your tax return. This includes monthly rent, retained security deposits, advance rent payments, and tenant-paid expenses. You must report this income regardless of your accounting method (cash or accrual).

You can deduct various expenses related to your rental property:

To maximize your deductions, maintain meticulous records of all these expenses.

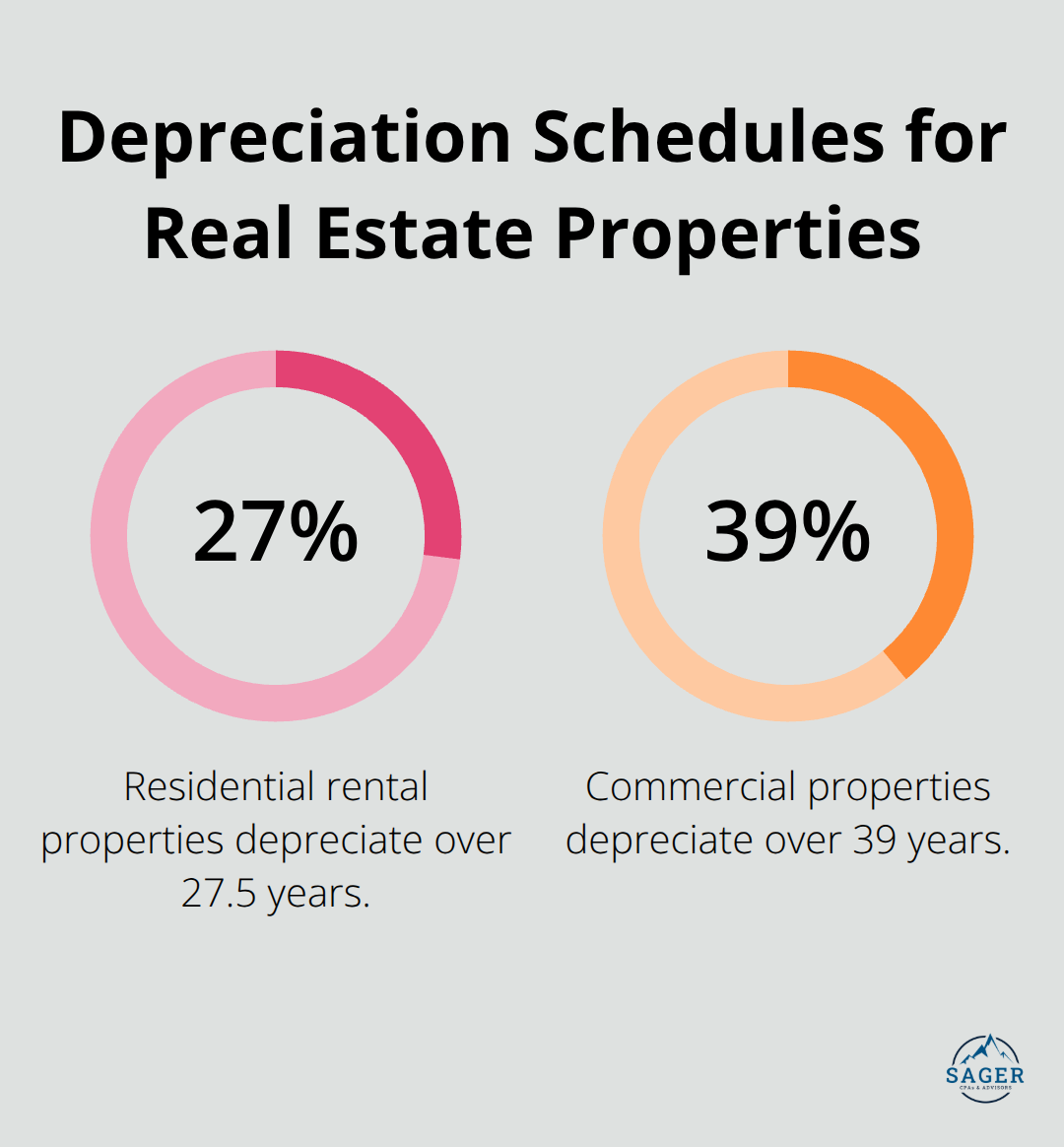

Depreciation allows you to deduct the cost of your property over time, reducing your taxable income. The IRS sets specific depreciation schedules:

However, be prepared for depreciation recapture when you sell. You’ll pay taxes on the accumulated depreciation at a 25% rate, which can result in a substantial tax bill.

When you sell a property, you must report the capital gain or loss on your tax return. Long-term capital gains rates (for properties owned over a year) are typically lower than ordinary income tax rates.

The IRS offers a significant tax break for primary residences:

(This exclusion doesn’t apply to investment properties.)

A 1031 exchange allows you to defer capital gains taxes by reinvesting the proceeds from the sale of one investment property into another “like-kind” property. Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section 1031. This strategy can help you grow your real estate portfolio without immediate tax consequences.

To qualify for a 1031 exchange, you must:

If you qualify as a real estate professional, you can deduct rental losses against your ordinary income. This status requires you to spend at least 750 hours per year in real estate activities and more time in real estate than in any other occupation.

Tax laws are complex and ever-changing. While this overview provides a foundation, consulting with a qualified tax professional will ensure you optimize your real estate investments while maintaining compliance with tax regulations. Let’s explore some strategies for tax-efficient real estate investing in the next section.

Real estate investing offers numerous tax advantages, but optimizing these benefits requires strategic planning. Let’s explore powerful strategies to enhance your tax position in real estate investments.

The 1031 exchange can help you defer capital gains taxes on one investment property by investing sale proceeds into another. This strategy allows you to defer capital gains taxes by reinvesting proceeds from a property sale into a like-kind property. Timing is critical – you must identify potential replacement properties within 45 days and complete the exchange within 180 days of selling your original property.

Consider this scenario: You sell a rental property for $500,000 with a $300,000 gain. You could potentially defer taxes on that entire gain by reinvesting in a property of equal or greater value. This approach preserves capital for reinvestment and potentially builds a larger real estate portfolio over time.

(It’s crucial to work with a qualified intermediary to ensure compliance with IRS regulations. Missteps in the process can disqualify the exchange, resulting in immediate tax liability.)

Depreciation, a non-cash expense, can significantly reduce your taxable income from rental properties. Residential properties typically depreciate over 27.5 years and commercial properties over 39 years. However, cost segregation studies can accelerate this process.

A cost segregation study can result in significantly increased cash flow by accelerating depreciation deductions. While the study has an up-front cost, the tax savings can be substantial. This approach front-loads your depreciation deductions, providing substantial tax savings in the early years of ownership.

Let’s look at an example: A $1 million property might typically yield about $36,000 in annual depreciation deductions. With a cost segregation study, you might claim $100,000 or more in the first year. For high-income investors, this could translate to tens of thousands in tax savings.

If you involve yourself heavily in real estate activities, qualifying as a real estate professional for tax purposes can offer significant benefits. This status allows you to deduct rental losses against your ordinary income, potentially lowering your overall tax bill.

To qualify, you must:

(For a married couple, only one spouse needs to meet these criteria.)

This status can particularly benefit you if you have high-income years from other sources and want to offset that income with real estate losses. However, you must maintain meticulous records of your time spent on real estate activities. The IRS scrutinizes these claims closely, so detailed logs are essential for substantiating your status.

Implementing these strategies requires careful planning and execution. The potential tax savings are substantial, but the complexities of real estate tax law demand expert guidance. As we move forward, we’ll explore even more advanced tax planning techniques that can further optimize your real estate investment strategy.

Real estate investors who seek to maximize their returns and minimize tax liabilities can leverage several sophisticated strategies. These approaches extend beyond basic deductions and require careful planning and execution.

Self-directed Individual Retirement Accounts (IRAs) present a unique opportunity for real estate investors. Unlike traditional IRAs, self-directed IRAs allow investments in alternative assets, including real estate. This strategy can provide significant tax advantages, as investments grow tax-deferred or even tax-free in the case of a Roth IRA.

The rules surrounding self-directed IRAs can be complex. The IRS prohibits certain transactions, such as self-dealing, where you or your immediate family directly benefit from the property held in the IRA. Violation of these rules can result in hefty penalties and immediate taxation of the entire IRA.

To implement this strategy effectively:

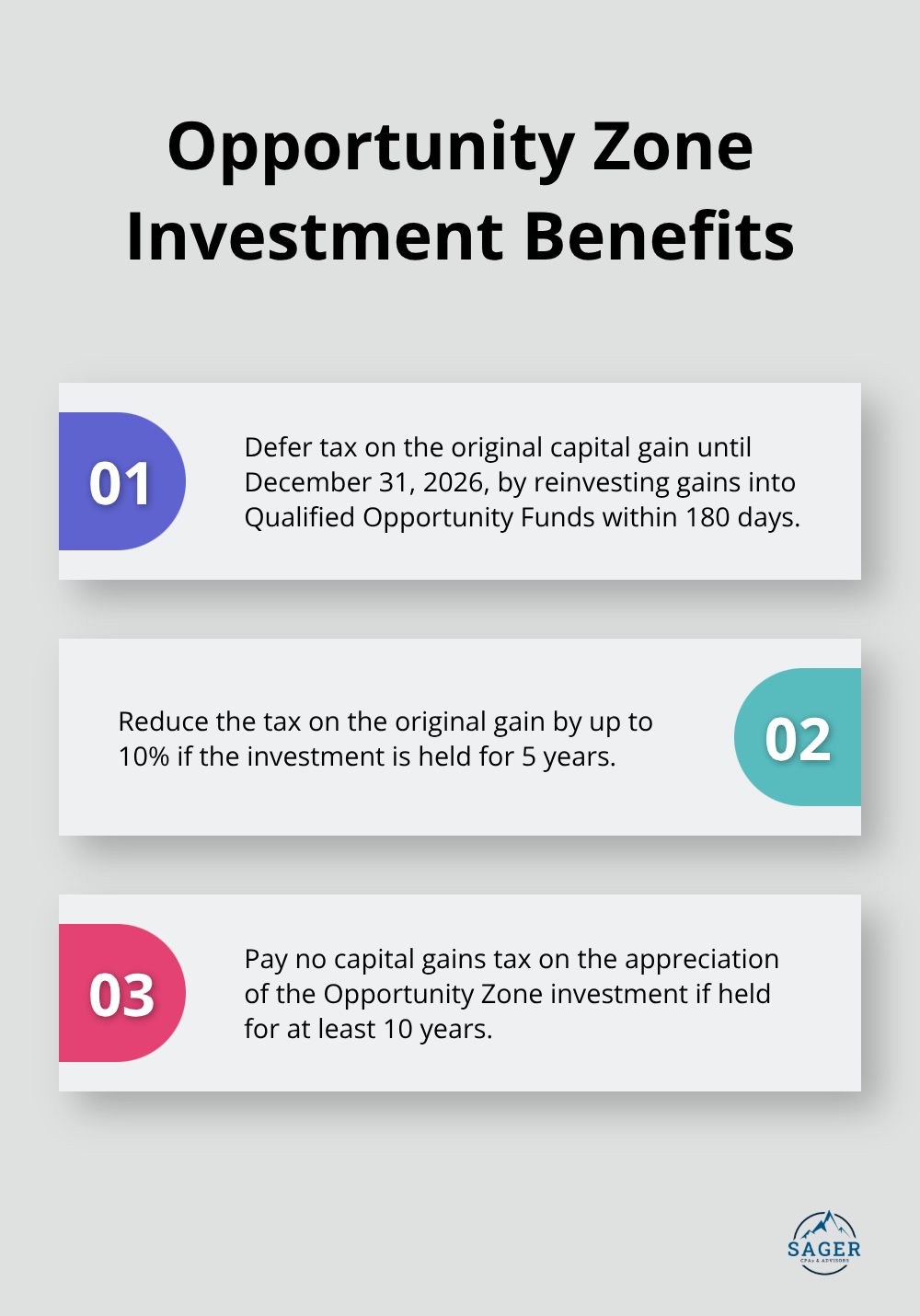

Opportunity Zone investments are economically-distressed communities that may qualify for tax deferment. Investors can defer capital gains taxes by reinvesting those gains into Qualified Opportunity Funds (QOFs) within 180 days of realizing the gain.

The tax benefits of Opportunity Zone investments follow a tiered structure:

Real Estate Investment Trusts (REITs) offer a way to invest in real estate without direct property ownership. REITs must distribute at least 90% of their taxable income to shareholders annually, resulting in high dividend yields. However, these dividends are typically taxed as ordinary income, not at the lower qualified dividend rate.

REIT investments can be particularly tax-efficient when held in tax-advantaged accounts like IRAs or 401(k)s. This strategy allows you to defer taxes on the high dividend payments and potentially withdraw them tax-free in retirement, depending on the account type.

For taxable accounts, consider the impact of REIT dividends on your overall tax situation. The high payouts can push you into a higher tax bracket if not managed carefully. Some investors opt for REIT ETFs or mutual funds to gain exposure to the real estate market while potentially benefiting from more favorable tax treatment on capital gains distributions.

Tax-loss harvesting involves selling underperforming investments to realize losses, which can offset capital gains from other investments. This strategy can help reduce your overall tax liability. In real estate, this might involve selling properties that have decreased in value to offset gains from more successful investments.

Installment sales for real estate allow you to include in income each year only the part of the gain you receive or are considered to have received. This can be particularly beneficial if you’re concerned about being pushed into a higher tax bracket in the year of the sale. By receiving payments over time, you can potentially reduce your overall tax liability and maintain a more consistent income stream.

Tax planning for real estate investments requires a strategic approach and understanding of various tax-saving opportunities. Investors can optimize their tax positions through 1031 exchanges, cost segregation studies, and achieving real estate professional status. Advanced strategies like self-directed IRAs, Opportunity Zone investments, and REITs offer additional avenues for tax-efficient wealth building.

Professional guidance proves essential in navigating the complexities of real estate tax planning. Tax laws evolve constantly, and mistakes can result in costly penalties or missed opportunities. Sager CPA specializes in providing expert financial management and tax planning services for real estate investors.

We offer comprehensive tax planning to reduce liabilities, strategic advisory services, and customized action plans. Our team works closely with clients to ensure every real estate investment decision considers its tax implications and overall financial impact. Effective tax planning for real estate creates a sustainable, long-term strategy that aligns with investment objectives and supports financial growth.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.