Many business owners operate with a business model and strategy that exist in separate silos. Your revenue streams, operations, and long-term goals should work together, not against each other.

At Sager CPA, we’ve seen firsthand how misalignment drains resources and slows growth. This guide walks you through identifying gaps, making strategic adjustments, and building a cohesive operation that actually delivers results.

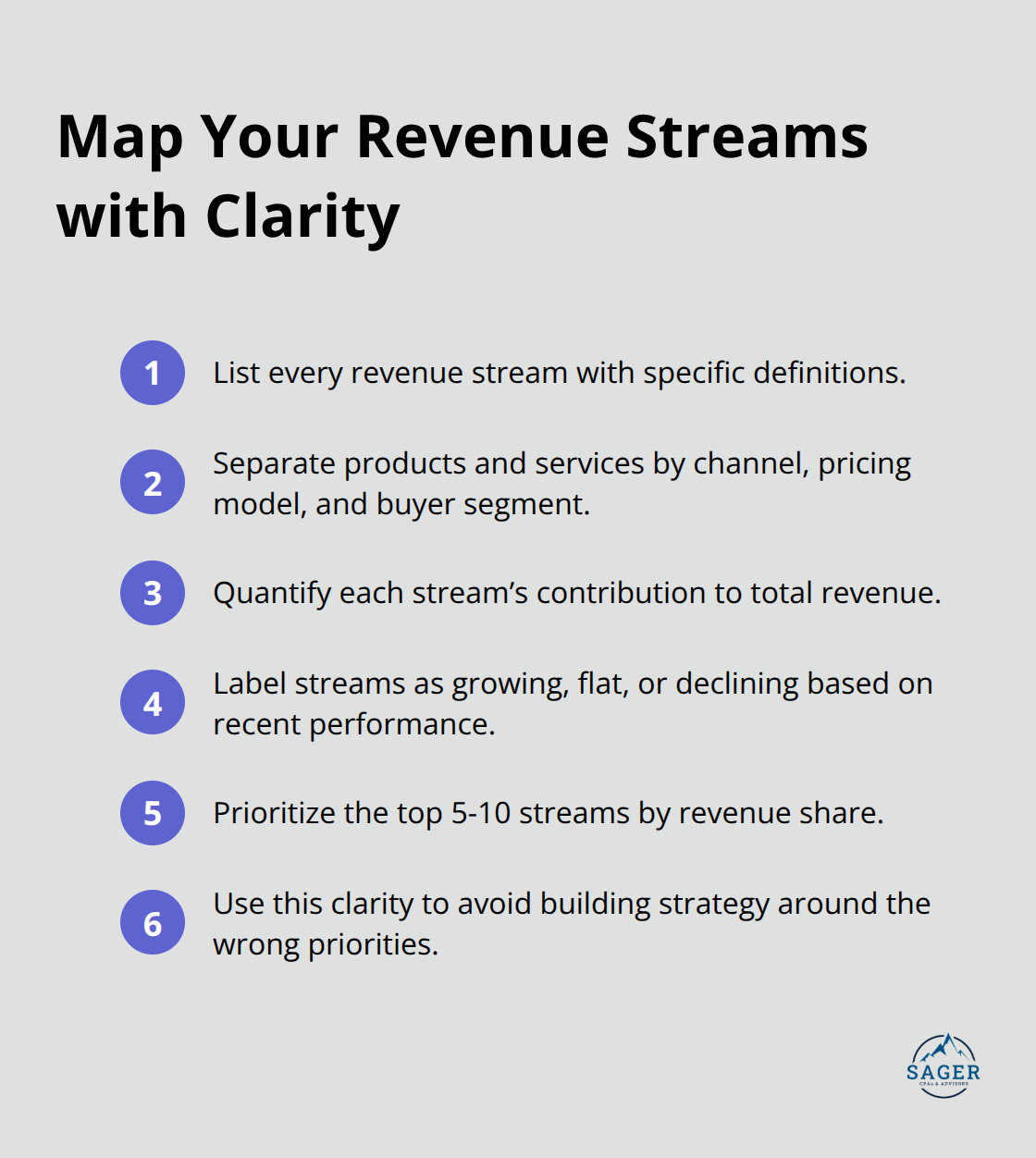

You cannot align a strategy to something you do not fully understand. Most business owners hold a fuzzy picture of how their company actually makes money and operates day-to-day. Start by documenting exactly where revenue comes from-not in broad categories, but with specificity. If you run a service business, break down revenue by service line, client segment, and pricing model. If you sell products, separate direct sales from wholesale, subscriptions from one-time purchases, or licensing fees from consulting add-ons. Many owners discover that 60-70% of their revenue comes from sources they assumed were minor, while their supposed flagship offering barely moves the needle. Write down your top five to ten revenue streams with their contribution to total revenue. Then identify which streams are growing, which are flat, and which are declining. This clarity prevents you from building a strategy around the wrong priorities.

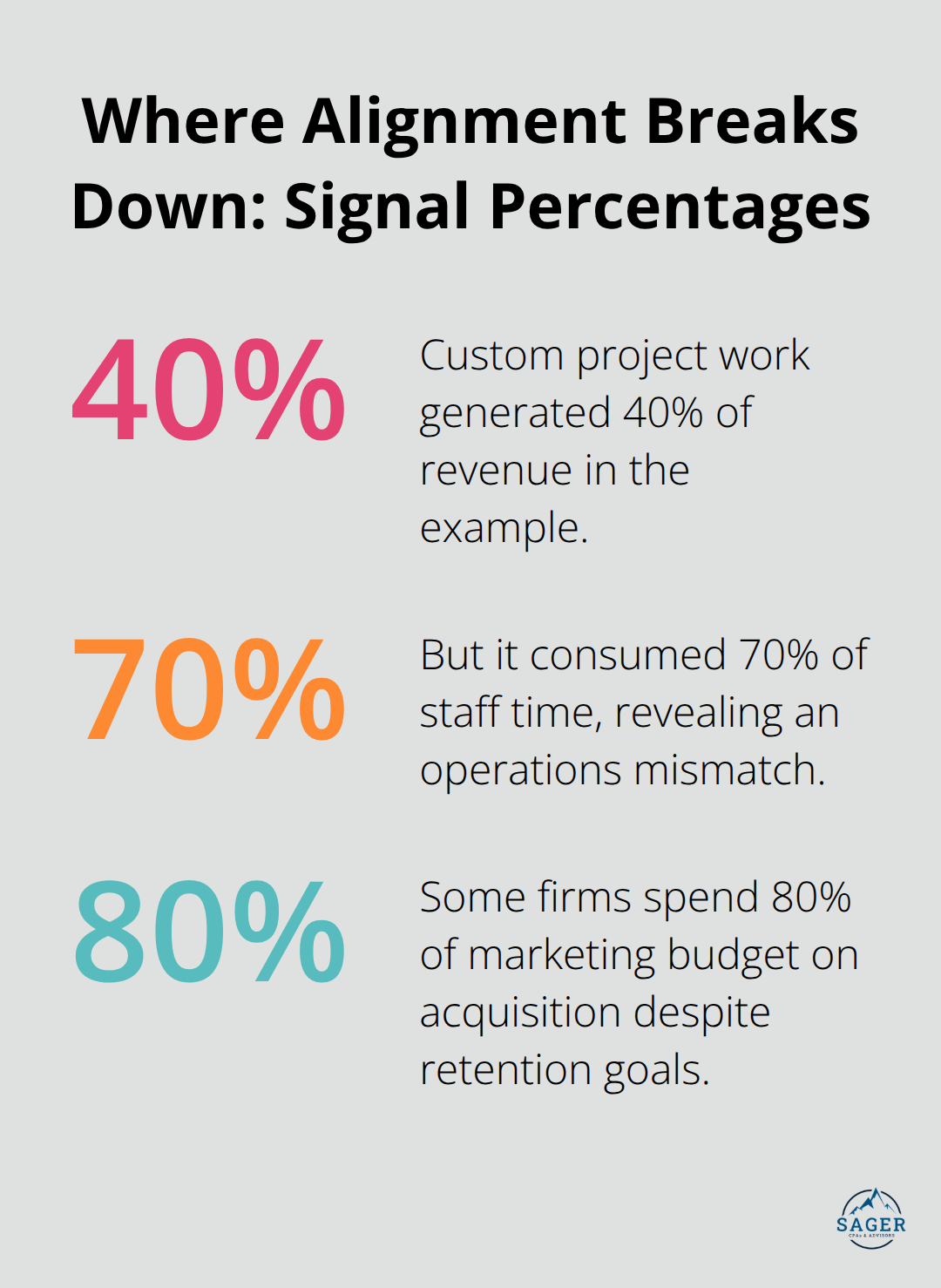

Next, map the core processes and activities that generate that revenue. Do not describe what you think happens-observe what actually happens. Track how a customer moves from prospect to paying client. Document the steps required to deliver your product or service. Identify which activities consume the most time, resources, and budget. Many business owners find that their most profitable revenue stream requires far fewer operational resources than their least profitable one. For example, a consulting firm might discover that custom project work generates 40% of revenue but consumes 70% of staff time, while productized service offerings generate revenue using optimized resource allocation. This mismatch is invisible until you map it. Write down your five to seven core processes, estimate the percentage of team capacity each requires, and note which processes directly support which revenue streams. Include hiring, training, delivery, customer support, and billing as distinct processes.

Finally, list your key resources and partnerships that enable your business model to function. Resources include your team members and their skills, technology systems, intellectual property, brand reputation, and financial capital. Partnerships include vendors, suppliers, distribution channels, technology partners, and strategic alliances. Evaluate which resources are scarce or hard to replace, and which partnerships are critical to your current revenue model. A software company might discover that their success depends entirely on one technology partner’s API stability, or that their sales growth is bottlenecked by a single distribution channel. A professional services firm might realize that their reputation in one niche market is their most valuable asset. Identify which resources and partnerships directly support your most profitable revenue streams versus which ones serve lower-margin business. This exercise reveals where you have real leverage and where you have hidden dependencies that could derail your strategy if disrupted.

With your business model fully documented, you now have the foundation to assess whether your strategy actually supports what your company does. The next step is to compare your current operations against your stated goals and identify the gaps that hold you back.

Now that you have documented your business model, the hard work begins: comparing what you say you will do against what you actually do. Most companies discover significant misalignment here, and the gap grows wider as the organization scales. Strategy execution gap research from MIT Sloan Management Review explores how organizations can achieve their strategic objectives. If your leadership team cannot articulate the strategy, your frontline staff certainly cannot execute it.

Write down your three to five primary strategic goals for the next 12 to 24 months. Then map each goal directly to the revenue streams, processes, and resources you documented earlier. Ask yourself hard questions: Does your budget allocation match these goals? If you claim that customer retention is a strategic priority but spend 80 percent of your marketing budget on customer acquisition, you have a problem. Do your hiring and team assignments reflect your stated priorities?

If product innovation is a strategic goal yet your engineering team handles maintenance work and technical debt, your strategy is fiction. Are you measuring progress on what actually matters? Many companies track metrics that feel productive but do not connect to strategic outcomes. A consulting firm might obsess over billable utilization rates while ignoring whether those billable hours generate profitable revenue or just keep people busy.

Pull your financial data from the last 12 months and compare resource allocation to stated strategy. Most business owners find that 40 to 60 percent of their operational capacity goes toward activities that do not directly support their top three strategic goals. One manufacturing company discovered that 45 percent of their production capacity went to a product line they had publicly committed to phasing out. Another service business realized their most strategically important client segment received less dedicated support than a legacy segment they inherited from an acquisition five years prior. These gaps exist because strategy gets written in a conference room, but operations continue on autopilot.

Your customer value proposition also needs scrutiny. Ask your sales team, your customer success team, and your actual customers what problem your company solves and why they chose you over competitors. Then compare those answers to your stated value proposition. To align your value proposition with customer needs, you must first gain a deep understanding of your target audience. A software company might believe they compete on advanced features while customers actually chose them because of responsive customer support and ease of implementation. A professional services firm might market themselves as industry specialists when customers hired them because of relationships with a specific partner or because they were simply available when others were not.

Your marketing message, pricing structure, and service delivery should all reinforce the value proposition your customers actually care about. If they do not align, you waste marketing spend and train your team to sell something your customers do not want to buy. This misalignment also creates friction in your operations-your team works harder to deliver something customers do not value, while the actual value you provide goes unrecognized and underpriced.

With your strategy and operations now exposed side by side, you can identify which adjustments will move the needle most. The next step is deciding where to focus your effort and how to build support across your organization for the changes ahead.

You now have a clear picture of where your business model and strategy diverge. The gap is real, documented, and visible to anyone who looks at your financials and operations side by side. The temptation at this point is to overhaul everything at once-cut the underperforming revenue streams, reallocate the entire budget, reorganize teams, and announce a bold new direction. This approach fails. Real alignment requires you to make surgical changes in sequence, build genuine support from the people who execute your strategy daily, and measure whether your adjustments actually work before scaling them.

Start by identifying which gaps drain the most resources or block your highest-priority goals. A service business bleeding 30 percent of capacity on a low-margin client segment should fix that before optimizing a process that consumes 5 percent of time. A software company whose sales team wastes effort on unqualified leads should tighten lead qualification before revamping their entire go-to-market strategy. Rank your gaps by the combination of resource impact and strategic importance, then tackle the top three to five.

Do not attempt more than five simultaneous changes-your organization has a finite capacity to absorb disruption, and spreading focus across too many initiatives guarantees that none of them stick. For each high-impact adjustment, calculate the financial benefit if you succeed. If reallocating resources from a declining product line to your strategic growth area would free up $200,000 in annual capacity and unlock an additional $500,000 in revenue opportunity, that clarity makes the business case obvious. If a change saves money but does not directly support your strategy, question whether it belongs in the first wave.

The people who execute your operations will resist changes they do not understand or that threaten their position. Announce the alignment gaps to your leadership team first, walk them through the data you collected, and ask them to identify gaps you may have missed. People who participate in diagnosis feel ownership of the solution.

Next, involve the teams whose work will change most directly-your operations manager, your sales leadership, your delivery team leads. Show them the misalignment through their own data. If your customer success team discovers that they spend twice as much effort supporting a legacy client segment as a newer, faster-growing segment, they already understand why change matters. Make the business case for each change explicit: what happens if you do nothing, what happens if you make the change, and how success affects their team.

Then give people a voice in how the change happens. Your operations team knows obstacles you cannot see from a spreadsheet. Your sales team knows which client segments are most likely to accept service changes without defecting. Involve them in designing the implementation, not just receiving the decision. This shifts resistance into problem-solving. Establish clear ownership for each major change-one person accountable for delivering the adjustment on time and within the resource budget you allocated. That person reports progress monthly to your leadership team and raises blockers immediately rather than letting them compound. Without clear ownership, changes slow down, drift from the original plan, and often fail silently while everyone assumes someone else is handling it.

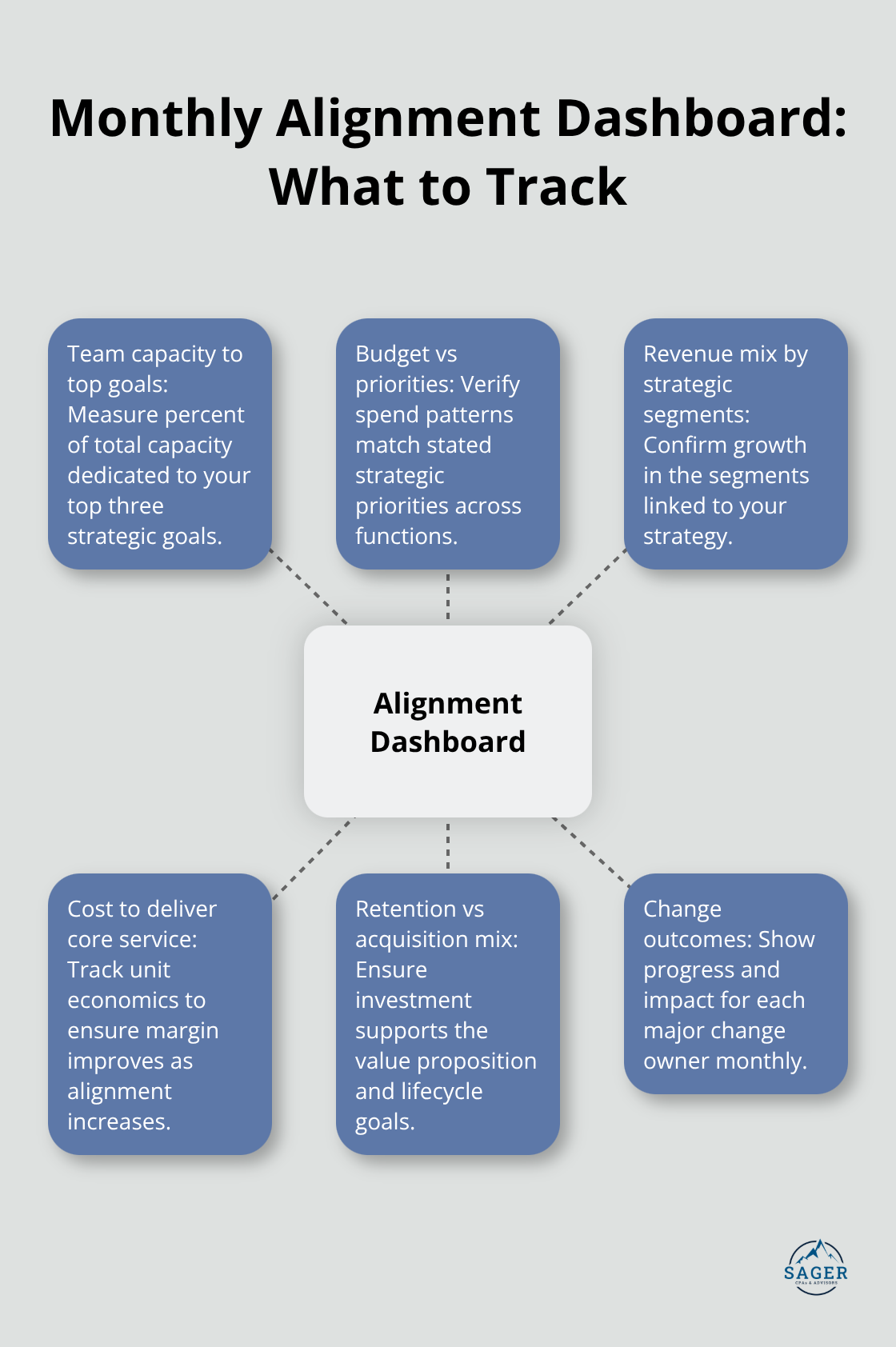

Most businesses track activity metrics that feel productive but do not connect to alignment. If you commit to reallocating resources toward a strategic growth area, measure whether that reallocation actually happened and whether it produced the expected results. Track the percentage of team capacity now allocated to your top three strategic goals each month. Track whether your budget allocation matches your stated priorities. If you said customer retention was critical but still allocate 75 percent of marketing spend to acquisition, you have not aligned.

Set up a simple dashboard that shows progress on each major change you are implementing-did you reduce time spent on the low-priority process, did you increase revenue from the strategic client segment, did you lower the cost to deliver your core service. Review this dashboard monthly with your leadership team. This forces accountability and catches drifting changes before they become invisible again. When a change produces results, celebrate it loudly and tie it explicitly to the alignment work you completed. When a change stalls, diagnose why immediately rather than letting it drag on for months. Sometimes your original assumption was wrong and the change should be abandoned. Sometimes the change is right but the implementation approach needs adjustment. Either way, you learn and move forward rather than letting failed changes become organizational scar tissue.

Alignment between your business model and strategy is not a one-time project you complete and then set aside. It is an ongoing discipline that separates companies that grow predictably from those that stumble through cycles of crisis and recovery. The work you have done in this guide-documenting your revenue streams, mapping your operations, identifying gaps, and implementing targeted changes-creates a foundation that compounds over time. When your organization operates with clear priorities and visible connections between daily work and strategic goals, people make better decisions without waiting for permission.

An aligned organization adapts faster because everyone understands the core strategy and can adjust tactics without losing sight of the mission. Your sales team qualifies leads against your actual value proposition instead of chasing every opportunity. Your operations team optimizes processes that directly support your strategy instead of perfecting workflows that do not matter. Your hiring focuses on skills that close real gaps instead of filling generic roles.

Start by scheduling a consultation with Sager CPA to review your financial data and identify where resources flow versus where your strategy says they should flow. That conversation often reveals gaps you cannot see alone and creates accountability for the alignment work ahead. Then commit to reviewing your business model and strategy alignment quarterly and track whether your resource allocation matches your stated priorities.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.