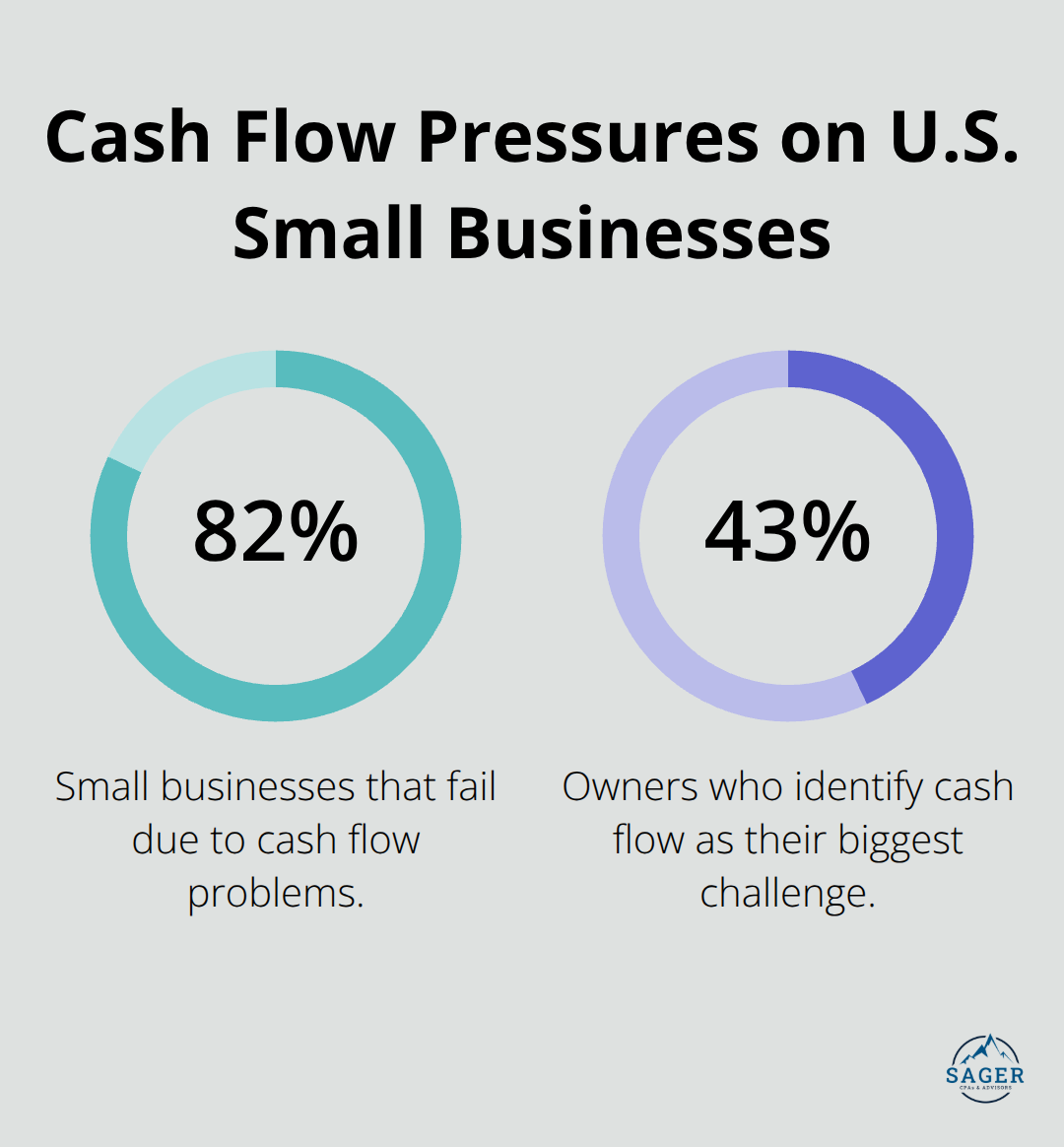

Small business financial planning separates thriving companies from those that struggle to survive. Without proper financial strategies, 82% of small businesses fail due to cash flow problems.

We at Sager CPA have seen countless businesses transform their operations through structured financial planning. This guide provides the essential tools and strategies you need to build a solid financial foundation for your business.

Financial planning success depends on three non-negotiable components that work together to create business stability. Cash flow forecasts form the foundation of every decision you make. Without accurate cash flow projections, 43% of small business owners identify cash flow as their biggest challenge, according to recent small business surveys. Smart forecasts track your receivables aging, monitor seasonal patterns, and project expenses 90 days ahead.

The cash conversion cycle is a financial metric measuring how long it takes to convert inventory and resources into cash from sales. Most profitable small businesses maintain a cash conversion cycle under 30 days.

Effective budgets go beyond expense tracking. Create zero-based budgets where every dollar has a purpose, and categorize expenses into fixed, variable, and discretionary spending. The 50-30-20 rule works for businesses too: allocate 50% for essentials like rent, inventory, staff wages, and utilities, 30% for wants, and 20% for savings. Small businesses that maintain detailed expense categorization reduce unnecessary spending by an average of 15% within six months. Track your gross profit margin monthly and investigate any decline that exceeds 2%. Variable expenses should never exceed 40% of your total revenue without clear growth justification.

Financial goal setting requires specific, measurable targets tied to key performance indicators. Monitor your current ratio, which should stay above 1.5 for healthy liquidity (this measures your ability to pay short-term debts). Track revenue per customer, customer acquisition cost, and lifetime customer value monthly. Your debt-to-equity ratio must remain below 40% to maintain financial flexibility. Establish monthly revenue targets based on trailing 12-month averages, then break these into weekly and daily goals. Review these metrics every 30 days and adjust strategies when performance deviates more than 10% from targets.

These financial fundamentals create the framework for success, but the right tools and techniques transform these concepts into actionable systems that drive consistent results.

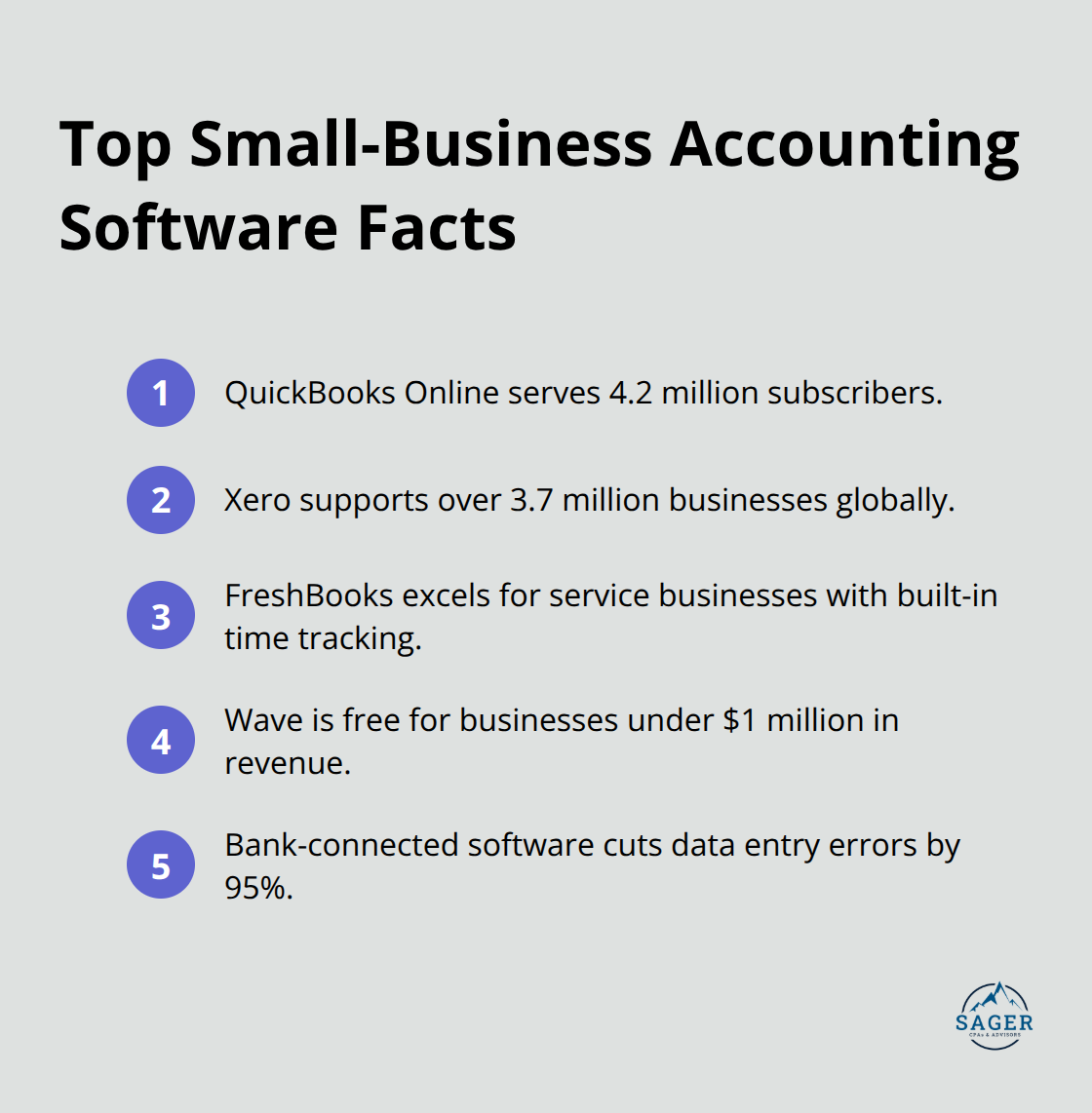

Modern accounting software eliminates guesswork from financial management and provides real-time insights that manual systems cannot match. QuickBooks Online dominates the small business market with 4.2 million subscribers, while Xero serves over 3.7 million businesses globally. These platforms automate transaction categorization, generate financial reports instantly, and integrate with bank systems for seamless reconciliation. FreshBooks excels for service-based businesses with time tracking capabilities, while Wave offers completely free accounting for businesses under $1 million in revenue.

Choose software that connects directly to your bank accounts and credit cards to reduce data entry errors by 95% compared to manual bookkeeping.

Financial statement analysis reveals patterns that predict cash flow problems months before they occur. Your profit and loss statement shows revenue trends, but the real insights come from calculating gross profit margins monthly and investigating any decline that exceeds 2%. The balance sheet current ratio of 1:1 or higher indicates sufficient liquid assets to cover current liabilities, while debt-to-equity ratios above 40% signal dangerous leverage levels. Cash flow statements expose timing gaps between sales and collections, with accounts receivable turnover ratios below 6 indicating collection problems. Small businesses that use monthly financial statement reviews identify cost overruns 60% faster than those that review quarterly.

Tax planning requires proactive strategies implemented throughout the year rather than scrambling during tax season. The Section 199A deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (potentially saving thousands annually). Equipment purchases through Section 179 provide immediate tax deductions up to $1.16 million for 2024, while bonus depreciation covers 80% of remaining costs. Quarterly estimated tax payments prevent penalties and improve cash flow management, with safe harbor rules that protect businesses paying 100% of prior year taxes. Small businesses that implement monthly tax planning reduce their effective tax rates by an average of 12% compared to reactive tax preparation approaches.

Performance tracking transforms raw financial data into actionable business intelligence. Monitor your gross profit margin weekly and investigate any fluctuation exceeding 3% from your baseline. Customer acquisition cost should never exceed 30% of customer lifetime value (this ratio indicates sustainable growth). Track inventory turnover rates monthly, with ratios below 4 signaling excess stock that ties up cash flow. Revenue per employee benchmarks help identify productivity gaps, with service businesses typically generating $150,000-$200,000 per employee annually.

Even the best tools fail without proper implementation, which means avoiding the common financial mistakes that derail small business success.

Financial mistakes destroy more small businesses than market competition or economic downturns. Poor cash flow management contributes to 82% of business failures, with specific patterns that repeat across industries. Cash flow mismanagement tops the list, where 38% of small business owners use personal funds to cover business expenses when cash runs short. This dangerous practice signals deeper problems: inadequate cash flow forecasts, poor collection procedures, and reactive financial management.

Late payment issues compound rapidly and create cascading financial problems. Businesses that allow customers to pay beyond 30 days experience collection rates that drop to 73%, while payments over 90 days have only a 57% collection probability according to credit management studies.

Implement automatic payment reminders at 15, 30, and 45 days past due. Charge late fees of 1.5% monthly on overdue balances and require deposits for new customers with poor payment histories. Small businesses that enforce strict collection policies maintain cash conversion cycles that average 23 days compared to 47 days for businesses with lenient payment terms.

Inadequate emergency plans leave businesses vulnerable to unexpected expenses or revenue drops. The Federal Reserve Bank of New York found that businesses with emergency funds equivalent to three months of expenses survive economic disruptions at rates 60% higher than underprepared competitors. Calculate your monthly fixed costs (rent, payroll, insurance, and loan payments), then multiply by three for your minimum emergency fund target. Service businesses need larger reserves because revenue fluctuates more dramatically than product-based companies. Store emergency funds in high-yield business savings accounts separate from operations to prevent accidental use.

Mixed personal and business finances create chaos and tax compliance problems. The IRS scrutinizes businesses that commingle funds, with audit rates that increase 400% for companies without clear financial separation. Open dedicated business accounts immediately, even for sole proprietorships. Personal expenses paid through business accounts become taxable income, while business expenses paid personally become difficult to deduct. Small businesses that maintain strict financial separation reduce costs by 30% and complete tax preparation 40% faster than businesses with mixed finances.

Small business financial planning transforms struggling companies into profitable enterprises through systematic cash flow management, strategic budgets, and performance tracking. Statistics show that businesses with structured financial plans survive economic disruptions at 60% higher rates than unprepared competitors. These results come from consistent application of proven financial principles rather than complex strategies.

You can start implementation with three immediate actions that create measurable results. Establish separate business accounts and conduct monthly financial statement reviews to maintain clear visibility. Create 90-day cash flow forecasts and set up automated payment reminders for customers to improve collection rates. Build emergency funds equal to three months of fixed expenses while you track key metrics like current ratios and gross profit margins weekly.

Professional guidance accelerates these results significantly and provides expertise that most business owners lack internally. We at Sager CPA help small businesses implement effective financial management strategies through expert accounting services and strategic tax planning. Small businesses that work with accounting professionals report 90% higher confidence in financial management and achieve better cash flow control than those that manage finances independently (compared to businesses without professional support).

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.