Environmental pressures are reshaping how businesses operate. Climate shifts, new regulations, and customer expectations mean that business strategy and the environment are now inseparable.

At Sager CPA, we’ve seen firsthand how companies that integrate environmental goals into their financial planning gain competitive advantages while reducing costs. This guide walks you through the practical steps to align your strategy with environmental responsibility.

Supply chains now carry measurable environmental risks that hit your bottom line immediately. Climate disruptions are no longer theoretical-they’re operational realities affecting inventory, transportation, and production timelines. The World Economic Forum reports that supply chains account for 50–70% of a company’s total emissions, meaning your suppliers’ environmental practices become your financial liability. A single weather event halts production for weeks, disrupts logistics networks, and forces emergency sourcing at premium costs. Companies that track supplier environmental performance gain visibility into these risks before they become crises. You need concrete data on where your materials originate, how they’re produced, and what environmental impact they carry. This isn’t about corporate responsibility alone; it’s about operational resilience and cost control.

Regulatory compliance has shifted from optional to mandatory, and the financial stakes are substantial. The International Sustainability Standards Board standards move sustainability reporting from voluntary disclosure to required standards, meaning your financial statements and risk disclosures will face increasing scrutiny.

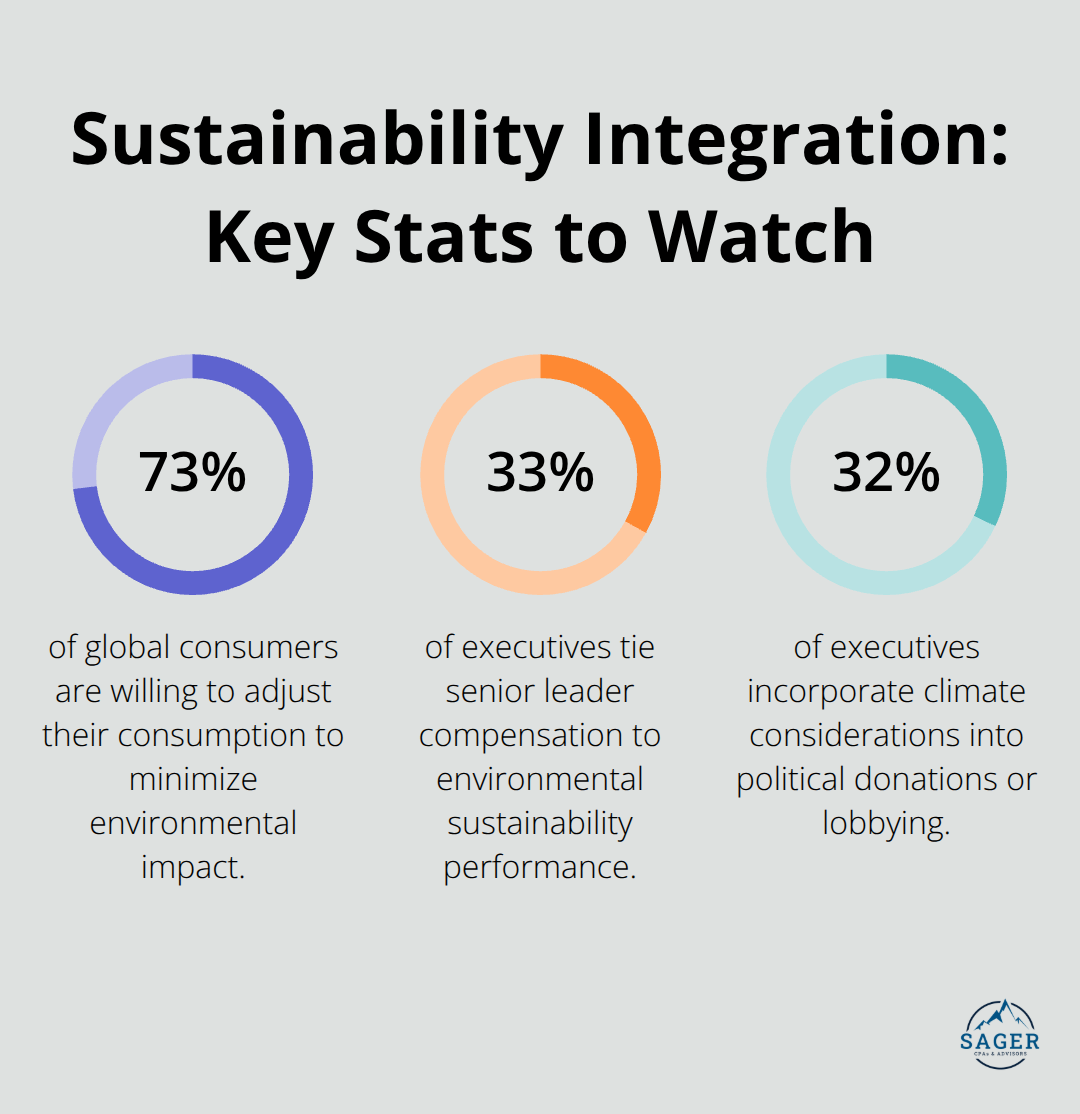

Governments worldwide tighten environmental regulations, and non-compliance carries real penalties-fines, production shutdowns, and damaged market access. Consumer demand reinforces this pressure: 73% of global consumers are willing to adjust their consumption to minimize environmental impact. Companies that ignore this trend lose market share to competitors who meet these expectations.

Environmental integration is no longer a marketing initiative but a financial and operational necessity. Organizations that embed sustainability into core strategy and operations-not as isolated initiatives-generate measurable cost savings through reduced energy consumption, waste reduction, and supply chain efficiency. Starting with a climate monitoring framework under existing disclosure standards reduces your initial reporting burden while building the data systems and governance you’ll need as regulations expand. This foundation positions you to respond quickly when new requirements arrive, rather than scrambling to build systems under pressure.

The next step involves translating these environmental pressures into concrete financial planning and measurable performance targets that your organization can track and improve.

Environmental metrics mean nothing without integration into your financial reporting systems. Deloitte’s research found that only 33% of executives tie senior leader compensation to environmental sustainability performance, and 32% incorporate climate considerations into political donations or lobbying. This gap reveals a critical problem: companies talk about environmental goals but fail to embed them into the incentive structures and financial systems that drive actual behavior. You need to measure what matters financially.

Start by identifying which environmental metrics directly impact your cost structure. Energy consumption, waste disposal, water usage, and supply chain emissions translate directly into dollars. Track these monthly alongside your standard financial reports, not in separate sustainability dashboards. When your CFO sees energy costs declining by 12% quarter-over-quarter because of equipment upgrades, that’s when environmental integration becomes real.

Companies that measure environmental performance using concrete financial metrics see operational benefits including reduced energy, water, and waste costs. The measurement framework matters enormously. Under IFRS Sustainability Disclosure Standards, starting with climate monitoring reduces your initial reporting burden while building the data systems you’ll need as regulations expand. This approach prevents the scramble that occurs when new requirements arrive without underlying infrastructure.

Assign clear accountability: designate your CFO or a cross-functional sustainability steering committee to own environmental data governance, just as you would with financial reporting controls. Environmental data is complex because products contain dozens of materials across multiple geographies, and suppliers may not provide complete information initially. Build data quality assurance processes that accept uncertainty. Use ranges and scenarios when perfect data doesn’t exist yet, rather than abandoning measurement altogether.

Budgeting for environmental initiatives requires a different mindset than typical capital expenditure decisions. Most companies reject sustainability investments because they focus only on direct payback periods. Deloitte Economics Institute modeling shows that if climate change goes unchecked, the global economy could lose around $178 trillion in net present value by 2070. That’s your real risk calculation.

Environmental investments often carry longer payback periods but deliver resilience against supply chain disruption, regulatory penalties, and market shifts. Allocate budget based on impact assessments of your highest-emission areas first. Circular supply chain models could unlock as much as $4.5 trillion in economic value by 2030 while reducing environmental damage. That’s not hypothetical; it’s the economic shift already happening.

When you budget for sustainable materials, energy efficiency, or supplier audits, frame these as risk mitigation and competitive positioning, not charity. Companies embedding sustainability into their strategic framework are 1.4 times more likely to achieve innovation breakthroughs. Your finance team should model scenarios where environmental investments generate new revenue streams through eco-friendly products or process improvements that reduce operational costs. For a company focusing on improving profitability, relevant KPIs might include gross profit margin, operating expense ratio, and return on invested capital. This positions sustainability as a growth driver, not a cost center.

The next step involves translating these financial frameworks into concrete operational actions that your organization can implement immediately.

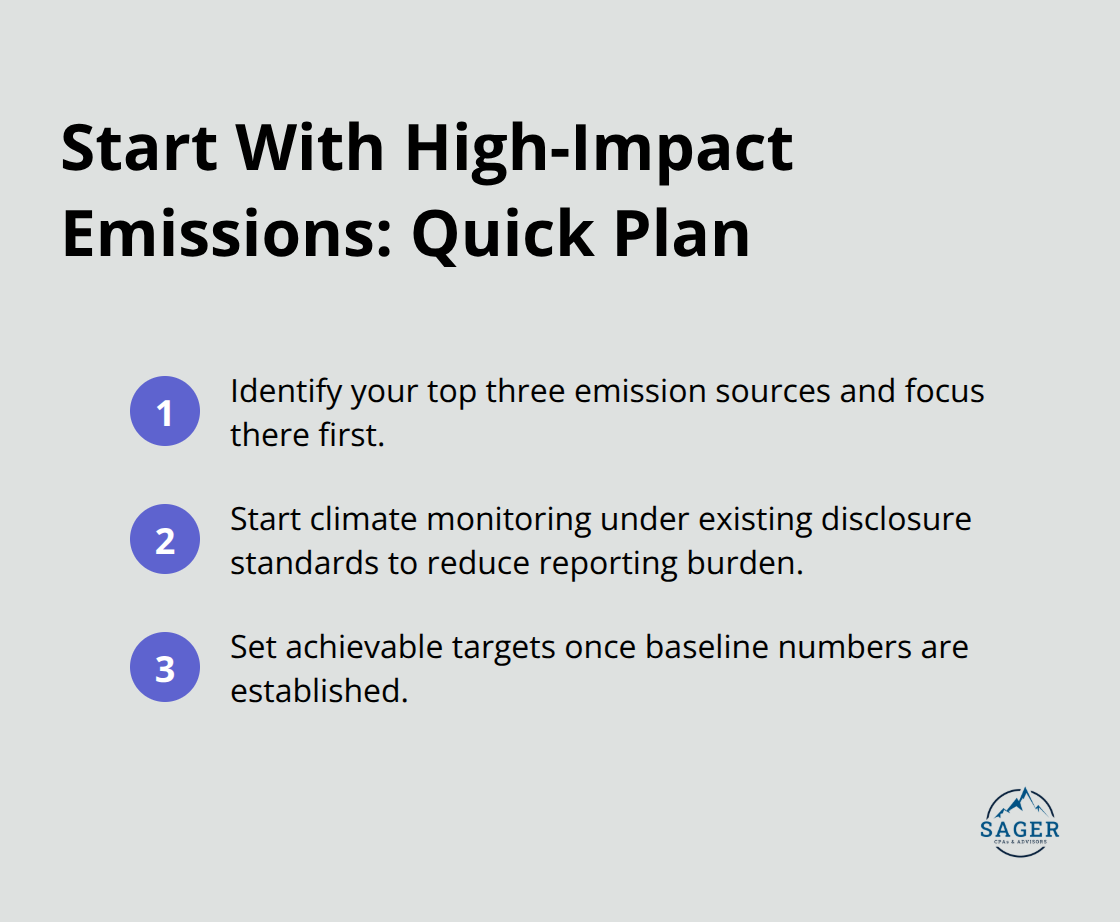

Start with what you can measure today, not what you wish you could measure tomorrow. An environmental audit of your current operations sounds comprehensive, but most companies approach it wrong by attempting to measure everything simultaneously across every facility and supplier. This creates analysis paralysis. Instead, identify your top three emission sources and focus there first. For a manufacturing company, this might be facility energy use, transportation logistics, and supplier production emissions. For a service business, it’s likely office energy, employee commuting, and cloud infrastructure.

Deloitte’s research shows that companies starting with climate monitoring under existing disclosure standards reduce their initial reporting burden while building the data systems they’ll need as regulations expand. Once you have baseline numbers for these high-impact areas, you can set targets that are actually achievable.

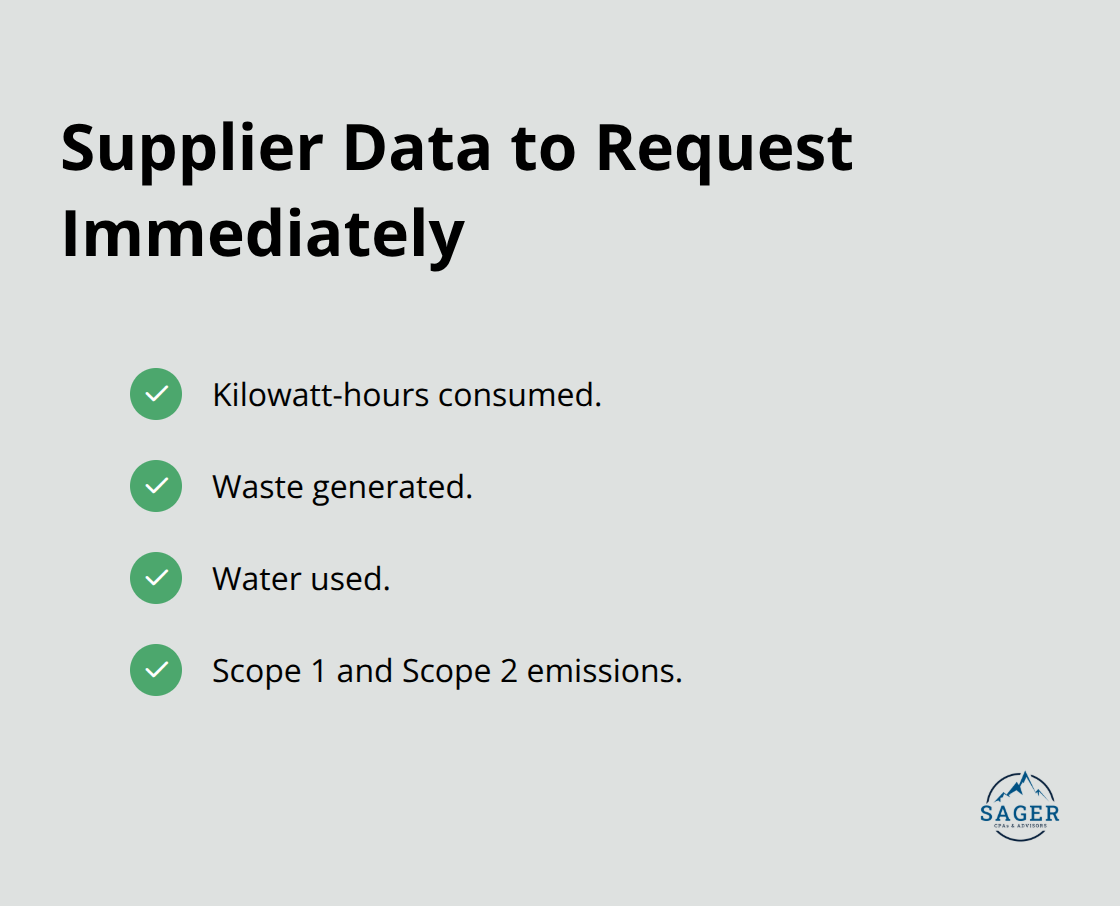

The World Economic Forum emphasizes that supply chains account for 50–70% of total emissions, so if you operate a product-based business, your supplier audit becomes non-negotiable. Contact your top 10 suppliers and request their environmental performance data. Most larger suppliers already track this; smaller ones may need guidance.

Request specific numbers: kilowatt-hours consumed, waste generated, water used, and scope 1 and 2 emissions. If a supplier refuses to provide data, that’s your signal to start evaluating alternatives. This isn’t punitive; it’s operational necessity. Companies that integrate environmental commitments throughout their supply chain by enforcing supplier CSR practices unlock competitive advantages through risk mitigation and innovation.

Setting realistic targets requires anchoring to concrete financial impact, not aspirational percentages. A 50% emissions reduction sounds impressive until you realize it requires operational changes that cost more than your projected savings. Instead, set SMART targets tied directly to your cost structure. If your facility energy bill runs $500,000 annually and an efficiency upgrade costs $200,000 with a three-year payback, that’s a realistic target. If switching to renewable energy costs $800,000 with a six-year payback, you need board approval and a clear business case explaining risk mitigation and competitive positioning.

Assign accountability to specific leaders, not committees. One person owns the energy efficiency target, another owns supplier compliance, another owns waste reduction. This creates urgency and clear responsibility.

Partner with suppliers who already demonstrate environmental commitment rather than trying to transform unwilling partners. If a supplier invests in renewable energy, maintains third-party certifications like B Corp or Climate Neutral, and publishes transparent environmental reports, they’re already aligned with your goals. These partnerships move faster because both parties share the same values and measurement frameworks.

If a supplier shows no environmental progress despite requests, replace them. This sends a market signal that environmental performance matters to procurement decisions, accelerating industry-wide change. Your partnership conversations should focus on specific metrics and timelines, not general sustainability statements. Ask suppliers what their 2030 targets are, how they measure progress, and whether they’ve achieved previous commitments. Vague answers indicate they haven’t embedded environmental responsibility into operations.

Environmental integration transforms from a compliance checkbox into a financial strategy when you tie it directly to your cost structure and hold leaders accountable for results. Companies that embed business strategy and the environment into their financial systems see measurable advantages: reduced operational costs, stronger supply chain resilience, and competitive positioning as regulations tighten. The organizations winning this transition measure environmental performance monthly alongside standard financial reports, not in separate sustainability dashboards disconnected from decision-making.

Start immediately with your three highest-impact emission sources and demand concrete data from your top suppliers. Set SMART targets anchored to actual costs, assign clear accountability to specific leaders, and partner with suppliers who already demonstrate environmental commitment rather than attempting to transform unwilling partners. These actions move environmental responsibility from marketing statements into operational reality within months, not years.

We at Sager CPA help businesses translate environmental goals into financial strategies that drive growth and resilience. Our team provides strategic business advisory services and comprehensive tax planning that accounts for the financial implications of environmental integration, building the financial systems and governance structures that make sustainability measurable and actionable. Schedule a consultation with our team to create a personalized strategy that aligns your business strategy and the environment with your financial position.

Phone: (208) 939-6029

Email: info@sager.cpa

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.